This is the first look at local markets in October. I’m tracking about 30 local housing markets in the US. Some of the 30 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

My view is that if the housing market is slowing, it will show up in inventory (not yet!).

The following data is important, especially active inventory and new listings. One of the key factors for house prices is supply, and tracking local inventory reports will help us understand what is happening with supply.

On a national basis, it is possible inventory will be up year-over-year sometime during the winter months, but inventory will still be at very low levels.

Denver, Las Vegas and Northwest (Seattle)

Here are a few local comments … “slower activity”, “slowing down a bit”

From Denver Metro Association of Realtors® (DMAR): DMAR Real Estate Market Trends Report

“Earlier in the year, expectations from sellers were that their homes would sell for substantially above asking price,” commented Andrew Abrams, Chair of the DMAR Market Trends Committee and Metro Denver Realtor®. “While properties are still closing above asking at 101.82 percent of the list price, realities have caught up with expectations. Buyers can be grateful that the extreme bidding wars are less common, and those without 20 percent to put down have a fair shot at a house and the continued low interest rates can keep monthly payments down.”

emphasis added

From Northwest Multiple Listing Service® Buyer hesitancy sidelines some while others compete for scarce housing inventory

Northwest Multiple Listing Service brokers are detecting indecisiveness by some buyers who are getting mixed "work from home" messages from their employers. The hesitancy, coupled with cooler, wetter weather and increases in mortgage rates were likely factors in slower listing and sales activity during October. …

John Deely, executive vice president of operations at Coldwell Banker Bain, suggested the cooler activity may be the result of several factors but also expressed some optimism. "While the overall slowdown in the market is seasonal and can be attributed to people being priced out of the market, as well as a slight uptick in interest rates, supply chain issues experienced with construction materials late this summer are beginning to normalize."

From Las Vegas Realtors® Southern Nevada home prices still setting records, but going up more gradually; LVR housing statistics for October 2021

“Our home prices are still increasing, but they’re going up more gradually,” said LVR President Aldo Martinez, a longtime local REALTOR®. “Even though we’re slowing down a bit, home prices are still rising. Buyers looking for more affordable options have been turning to condominiums and townhomes, as witnessed by the median condo price of $236,000. As we’ve been saying for some time, the rate of appreciation we’ve seen this year is great for homeowners, and the low interest rates have been great for home buyers.”

Active Inventory in October

Here is a summary of active listings for these housing markets in September. Inventory was down 12.5% in October MoM from September, and down 28.6% YoY.

Inventory almost always declines seasonally in October, so the MoM decline is not a surprise. Last month, these three markets were down 24% YoY, so the YoY decline in October is larger than in September. This isn’t indicating a slowing market (but this is just 3 early reporting markets).

Notes for all tables:

New additions to table in BOLD.

Northwest (includes Seattle)

Please share with your friends and colleagues!New Listings in October

And here is a table for new listings in October. For these three areas, new listings were down 10.3% YoY.

Last month, new listings in these three markets was down just 1.8%.

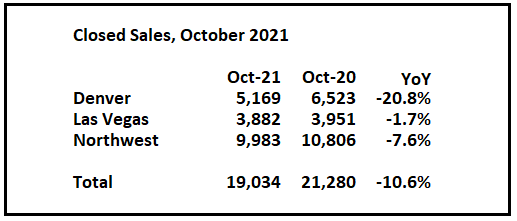

Closed Sales in October

And a table of October sales. Sales were down 10.6% YoY, Not Seasonally Adjusted (NSA). Sales in Las Vegas were only down slightly (a shift to more condos).

Last month, sales were down 5.1% YoY for these three markets.

Please subscribe for housing data and analysis.