NOTE: The tables for active listings, new listings and closed sales all include a comparison to October 2019 for each local market (some 2019 data is not available).

This is the second look at local markets in October. I’m tracking over 40 local housing markets in the US. Some of the 40 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

Closed sales in October were mostly for contracts signed in August and September when 30-year mortgage rates averaged 6.50% and 6.18%, respectively (Freddie Mac PMMS). These were the lowest mortgage rate in 2 years!

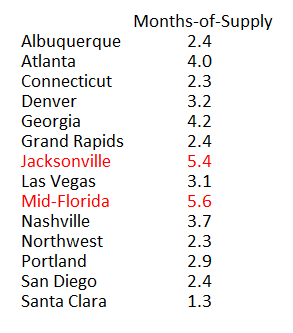

Months of Supply

Here is a look at months-of-supply using NSA sales. Note the regional differences, especially in Florida (although October statistics in Florida were impacted by Hurricane Milton). This pickup in inventory is impacting prices in Florida.

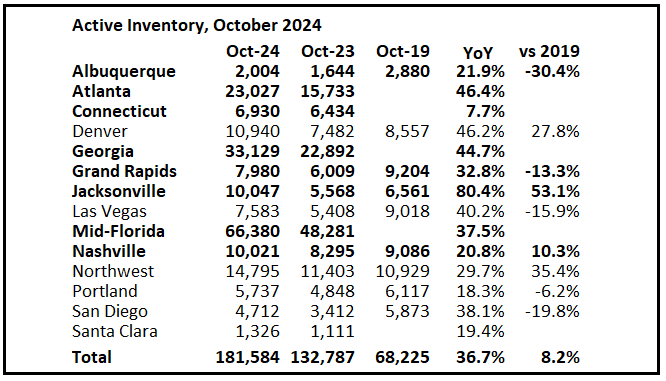

Active Inventory in October

Here is a summary of active listings for these housing markets.

Inventory was up 36.7% year-over-year. Last month inventory in these markets was up 43.9% YoY. A key for house prices will be the level of inventory over the Winter.

There are significant regional differences for inventory, with sharp increases in the South and Southeast (especially in Florida and Texas).

Notes for all tables:

New additions to tables in BOLD.

Northwest (Seattle), Jacksonville Source: Northeast Florida Association of REALTORS®

Totals do not include Atlanta (included in state total)

Comparison to 2019 ONLY includes local markets with available 2019 data!

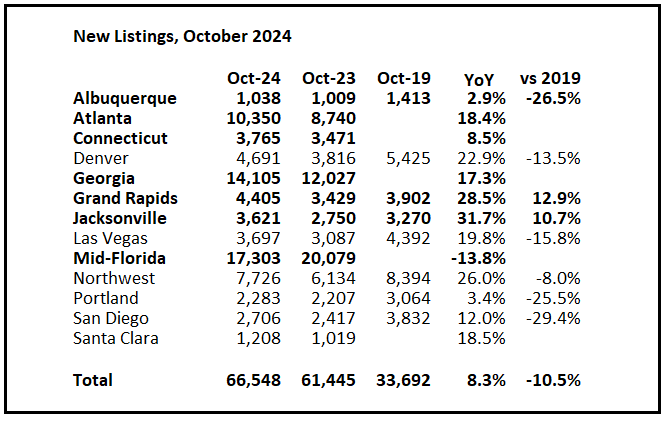

New Listings in October

And here is a table for new listings in October (some areas don’t report new listings). For these areas, new listings were up 8.3% year-over-year.

Last month, new listings in these markets were up 7.6% year-over-year.

New listings are now up year-over-year, but still at historically low levels. New listings in most of these areas are down compared to October 2019 activity.

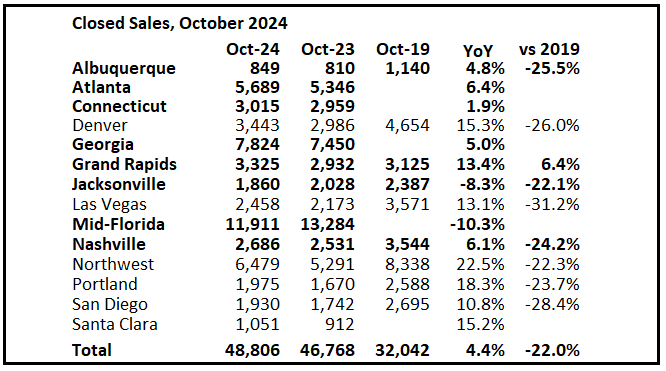

Closed Sales in October

And a table of October sales.

In October, sales in these markets were up 4.4% YoY. Last month, in September, these same markets were down 5.3% year-over-year Not Seasonally Adjusted (NSA).

Note that the areas that were down year-over-year were impacted by Hurricane Milton.

Important: There was one more working day in October 2024 (22) as in October 2023 (21). So, the year-over-year increase in the headline SA data will be less than the NSA data indicates. Last month there were the same number of working days in September 2024 compared to September 2023 (22 vs 23), so seasonally adjusted sales were down about the same as NSA sales.

Sales in all of these markets - except Grand Rapids - are down significantly compared to October 2019.

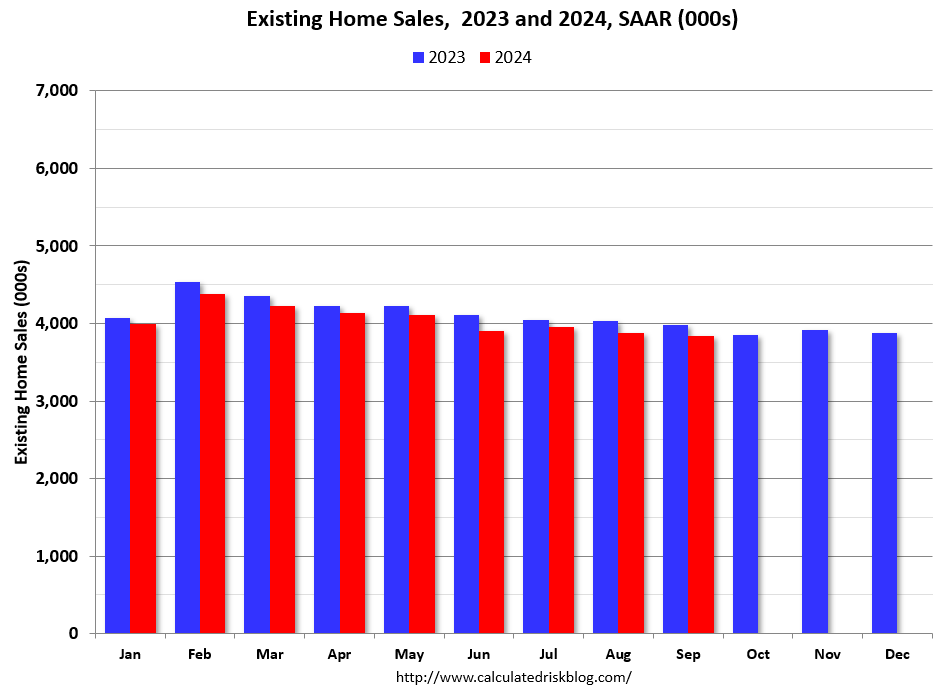

This graph shows existing home sales by month for 2023 and 2024, on a Seasonally Adjusted Annual Rate (SAAR) basis. Last year, the NAR reported sales in October 2023 at 3.85 million SAAR.

This data suggests that the October existing home sales report will show a solid year-over-year increase. This will be the first year-over-year gain since August 2021 following 37 months with a year-over-year decline. Of course, sales will still be historically low, and mortgage rates have increased recently, are back over 7%, and this will likely depress sales in coming months.

Many more local markets to come!