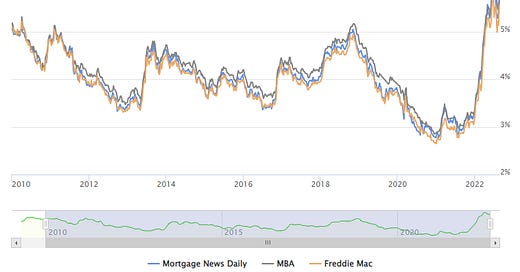

30-Year Mortgage Rates Pushing 6% Again

After reaching 6.28% on June 14th, 30-year mortgage rates decreased to a low of 5.05% on August 1st according to Mortgagenewsdaily.com. Since then, rates have been moving up, and rates increased today to 5.95%, probably due to Fed Chair Powell’s speech on Friday.

A few key excerpts from Powell’s speech that impacted rates:

While higher interest rates,…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.