3rd Look at Local Housing Markets in July, Sales Down Sharply

The big story for July existing home sales is the sharp year-over-year (YoY) decline in sales. Another key story is that new listings are down YoY in July. Of course, active listings are up sharply.

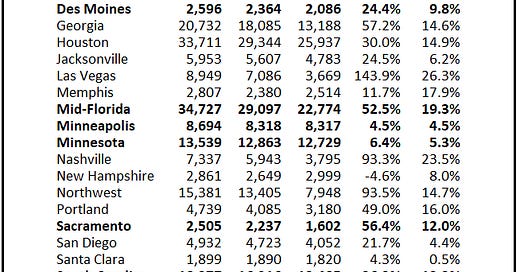

This is the third look at local markets in July. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metro…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.