3rd Look at Local Housing Markets

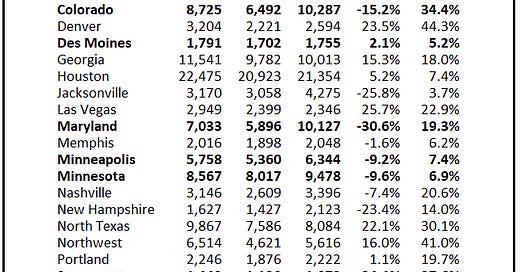

Adding Austin, Boston, California, Colorado, Des Moines, Maryland, Minneapolis, Minnesota, Sacramento, South Carolina and Washington, D.C.

This is the third look at local markets in April. I’m tracking about 35 local housing markets in the US. Some of the 35 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

We are seeing a significant change in inventory, but there is no surge in new listings. This means the in…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.