A Few Comments on Commercial Real Estate

The Office Sector will see an increase in delinquencies

The focus of this newsletter is residential real estate, although I follow several commercial real estate (CRE) sectors on my blog. There have been numerous warnings recently about a potential CRE lending crisis and I’d like to add a few comments.

First, when most people think “CRE” they think office and retail space. The concern for retail is online shopping eroding in-store buying (a long-term trend), and work-from-home (WFH) reducing the need for office space (another long-term trend that increased sharply during the pandemic but has reversed recently).

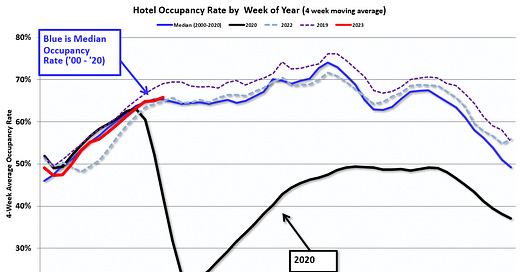

However, there are many other CRE sectors in addition to office and retail: lodging (hotels), health care, warehouses (including self-storage), manufacturing facilities, food and beverage establishments, power and communication, amusement and recreation (Disneyland!), religious, transportation and more.

Most of these other CRE sectors are fine. Of the $11.1 trillion invested in CRE since the year 2000 (according to the BEA), about 12% was in offices and 4% in malls. These are important sectors, but there is much more to CRE.

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.