Architecture "Billings remain soft to start 2026"

Pending Home Sales Decreased 0.4% Year-over-year in January

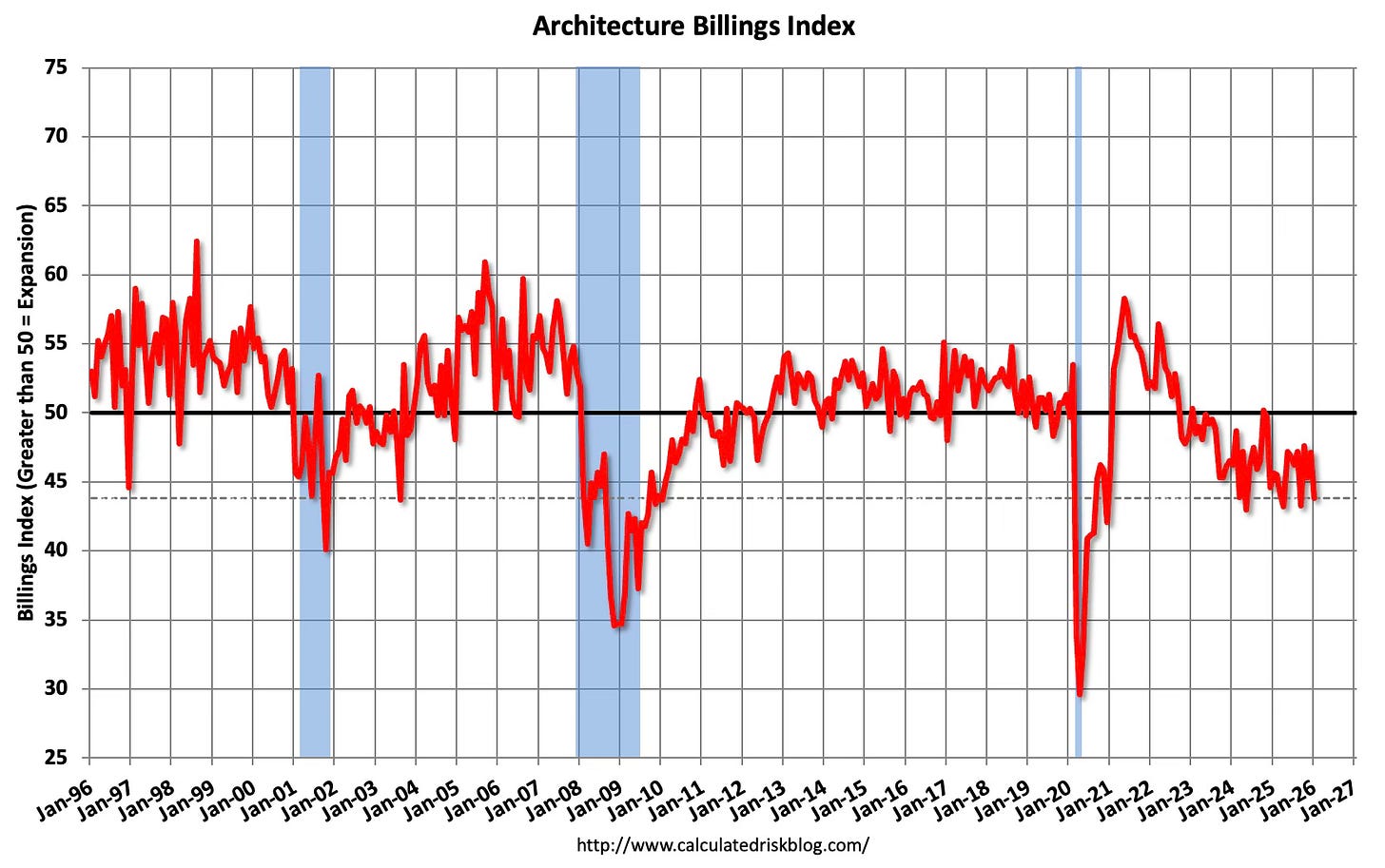

Architecture Billings Index in Contraction for 37 of Last 40 Months

This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment including multi-family residential.

From the AIA: Business conditions at architecture firms remained soft to start 2026

The AIA/Deltek Architecture Billings Index® (ABI) score for the month declined to 43.8 from 47.1 last month, indicating that more firms saw a decline in billings in January than in December. In addition, inquiries into new projects declined for the first time since April 2025, and the value of newly signed design contracts also softened. There remains uncertainty among clients about starting new work, and the new projects that do get started tend to be smaller than in the past.

Billings declined at firms across all regions of the country in January, except in the South, where they were essentially flat. While firms located in the Midwest saw some growth in late 2025, that growth has now receded, and firms in that region are seeing declines again. Business conditions also remained soft at firms of all specializations in January, although the pace of the billings decline has slowed in recent months at firms with a multifamily residential specialization. However, these firms have still not seen any billing growth since mid-2022.

...

The ABI serves as a leading economic indicator that leads nonresidential construction activity by approximately 9-12 months.

emphasis added

• Northeast (42.3); Midwest (46.3); South (50.2); West (46.3)

• Sector index breakdown: commercial/industrial (43.9); institutional (46.8); multifamily residential (48.4)

This graph shows the Architecture Billings Index since 1996. The index was at 43.8 in January, up from 47.1 in December. Anything below 50 indicates a decrease in demand for architects’ services. This index has indicated contraction for 37 of the last 40 months.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions. This index typically leads CRE investment by 9 to 12 months, so this index suggests a slowdown in CRE investment throughout 2026.

Multi-family billings have been below 50 for 42 consecutive months. This suggests we will some further weakness in multi-family starts.

Pending Home Sales Decrease 0.8% in January

From the NAR: NAR Pending Home Sales Report Shows 0.8% Decrease in January

Pending home sales in January decreased by 0.8% from the prior month and 0.4% year-over-year, according to the National Association of REALTORS® Pending Home Sales Report....

Month Over Month

0.8% decrease in pending home sales

Gains in the Midwest and West; declines in the Northeast and South

Year Over Year

0.4% decrease in pending home sales

Gains in the South and West; declines in the Northeast and Midwest

“Improving affordability conditions have yet to induce more buying activity,” said NAR Chief Economist Dr. Lawrence Yun.

This was below the consensus expectation of a 2.6% increase in the index. Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in February and March.