Asking Rents Down 1.2% Year-over-year

Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand).

The surge in household formation has been confirmed (mostly due to work-from-home), and this led to the supposition that household formation would slow sharply in 2023 (mostly confirmed) and that asking rents might decrease in 2023 on a year-over-year basis (now negative year-over-year).

Recent data suggests household formation has slowed sharply and asking rents are declining year-over-year. With a near record number of multi-family units under construction, slow household formation, rising vacancy rates, and soft rents, most builders expect to start fewer multi-family units in 2024.

Rick Palacios Jr., Director of Research at John Burns Research and Consulting noted yesterday:

Apartment developers and investors we just surveyed expect a big drop in starts over the next 12 months.

25% expect apartment starts to fall by 50%+, and 52% expect a drop of 20%+. Very, very few expect growth ahead.

First, a survey of rent reports …

Apartment List: Asking Rent Growth -1.2% Year-over-year

From ApartmentList.com: Apartment List National Rent Report

Welcome to the November 2023 Apartment List National Rent Report. The seasonal slowdown in the rental market continued this month, with the nationwide median rent falling by 0.7 percent to $1,354. This marks the third consecutive month of negative rent growth, and declines are likely to persist in the coming months as we head into the winter.

Year-over-year rent growth remains in negative territory at -1.2 percent, meaning that on average, apartments across the country are slightly cheaper today than they were one year ago. This stands in sharp contrast to the prevailing conditions of 2021 and 2022, when rent prices were surging and year-over-year growth peaked at 18 percent nationally. But despite the cooldown of the past year, the national median rent is still nearly $250 per month more expensive than it was just three years ago. …

This is the second steepest October rent decline that we’ve seen in the history of our index (going back to 2017). The only time that October brought a sharper decline was last year, when rents fell by 0.8 percent as the market shifted into the period of sluggishness that still persists. For comparison, from 2017 to 2020, October declines ranged from -0.4 to -0.6 percent.

On a year-over-year basis, rents nationally are down 1.2 percent. Year-over-year rent growth fell to zero in June for the first time since the disruption of the early stages of the pandemic, and has now been in negative territory for four consecutive months. …

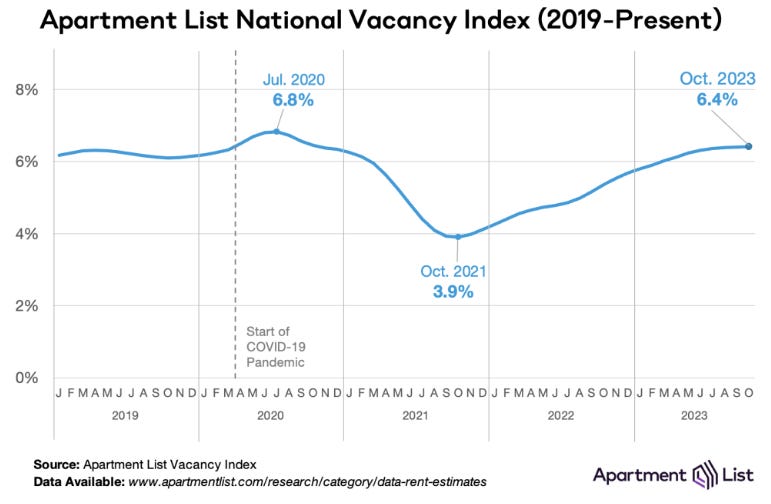

[A]fter bottoming out in October 2021, our national vacancy index has been easing steadily for two full years. As of this October, the index stands at 6.4 percent, representing a return to pre-pandemic levels. …

emphasis added

Realtor.com: Fifth Consecutive Month with Year-over-year Decline in Rent

From Realtor.com: September 2023 Rental Report: Rent Prices Fall for Fifth Consecutive Month Amid Strong Demand for Affordable Units

In September 2023, the U.S. median rent continued to see a year-over-year decline for the fifth month in a row, down -0.7% for 0-2 bedroom properties across the top 50 metros, at a similar rate of -0.6% seen in August. The median asking rent was $1,747, down by $5 from last month and $29 less from the peak seen in July 2022. However, it was still $338 (24.0%) higher than the same time in 2019 (pre-pandemic).

CoreLogic: “16th consecutive month” of Deceleration

CoreLogic also tracks rents for single family homes: CoreLogic: Annual US Rent Growth Continues to Moderate in August but Price Squeeze Persists

Annual U.S. single-family rent growth slowed to 2.9% in August, the 16th consecutive month of declines. …

“While annual single-family rent growth has returned to a moderate pace, more than three years of substantial increases will have a lasting impact on tenants’ budgets,” said Molly Boesel, principal economist for CoreLogic. “Single-family rents grew by 30% since February 2020, and small drops in some areas barely put a dent in the overall, cumulative increase.”

The 2.9% YoY increase in August was down from 3.1% in July.

Real Page: “Year-over-year, same-store effective asking rents for new leases inched up just 0.28% in August”

From Jay Parsons at Real Page: Apartment Demand is Normalizing, But Soaring Supply Flattens Rents

High supply has flipped the rental market narrative over the last 18 months from record-low vacancy and record-high rent growth to now normalized vacancy and flat-to-falling rents.

Nationally, effective asking rents fell 0.3% in September. That cut brought year-over-year rent growth down to just 0.1%, compared to 9.0% just one year ago.

Rent Data

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.