Asking Rents Mostly Unchanged Year-over-year

Another monthly update on rents.

Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand). Now that household formation has slowed, and multi-family completions have increased, rents are under pressure.

Apartment List: Asking Rent Growth -0.8% Year-over-year

From ApartmentList.com: Apartment List National Rent Report

Rents are up 0.2% month-over-month, down 0.8% year-over-year

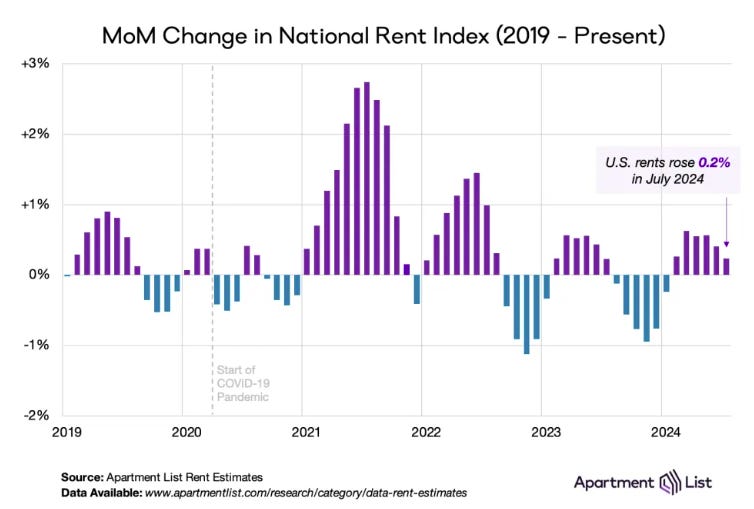

Welcome to the August 2024 Apartment List National Rent Report. Rent prices ticked up for the sixth straight month, but rent growth over the course of 2024 as a whole remains modest, signaling ongoing sluggishness in the market. And while month-over-month rent growth remains positive, it is decelerating. Prices increased just 0.2% in July and today the nationwide median rent stands at $1,414. It is very possible that rent growth will turn flat or negative in August, and stay there for the remainder of the year.

Since the second half of 2022, seasonal declines in rent prices have been steeper than usual and seasonal increases have been more mild. As a result, apartments are on average slightly cheaper today than they were one year ago. Year-over-year rent growth currently stands at -0.8 percent and has now been in negative territory for over a full year. Despite this, the national median rent is still more than $200 per month higher than it was just a few years ago.

On the supply side of the rental market, our national vacancy index remains slightly elevated, currently standing at 6.7 percent. After a historic tightening in 2021, multifamily occupancy has been slowly but consistently easing for over two years. And with 2024 bringing the most new apartment completions in decades, we expect that there will continue to be an abundance of vacant units on the market in the year ahead.

Realtor.com: Eleventh Consecutive Month with Year-over-year Decline in Rents

From Realtor.com: June 2024 Rental Report: Median Asking Rents Continue To Fall

In June 2024, the U.S. median rent continued to decline year over year for the 11th month in a row, down $7 (-0.4%) for 0-2 bedroom properties across the top 50 metros, slower than the rate seen in May 2024. The median asking rent was $1,743, up by $13 from last month following a typical seasonal trend.

Despite the 11th month of decline, the U.S. median rent was just $11 less (-0.6%) than the peak seen in August 2022. Notably, it was still $305 (21.2%) higher than the same time in 2019 (pre-pandemic), but this increase is roughly on par with what has occurred in overall consumer prices (up 22.6% in the five years ending June 2024) and pales in comparison to the 52.6% increase in the median price per square foot of for-sale home listings in the five years ending June 2024.

CoreLogic: Rent Growht “Inches Up” For Single-Family

CoreLogic also tracks rents for single family homes: July 18, 2024 CoreLogic: US Annual Rental Price Growth Rate Inches up to Highest Rate of 2024 in May

Single-family rents rose by 3.2% year over year in May, the highest rate of growth since April 2023.

The 3.2% YoY increase for single-family homes in May was up from 3.0% YoY in April.

Rent Data

The following content is for paid subscribers only. Thanks to all paid subscribers!

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.