Asking Rents Mostly Unchanged Year-over-year

Another monthly update on rents.

Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand). Now that household formation has slowed, and multi-family completions have increased, rents are under pressure.

First, a survey of rent reports …

Apartment List: Asking Rent Growth -0.8% Year-over-year

From ApartmentList.com: Apartment List National Rent Report

Welcome to the April 2024 Apartment List National Rent Report. The rental market continued to pull out of its slow season in March; prices ticked up 0.6 percent this month, the second consecutive monthly increase following six straight months of rent declines. The nationwide median rent now stands at $1,388. This turnaround is in line with the rental market’s typical seasonal pattern, as we transition into the time of year when moving activity starts to gradually pick back up after bottoming out around the holidays.

Rents are up 0.6% month-over-month, down 0.8% year-over-year

Rent growth follows a seasonal pattern – rent increases generally take place during the spring and summer, whereas the fall and winter usually see a modest price dip. We are currently transitioning into the busy season, with the national median rent increasing for the second straight month, following six consecutive monthly declines from August 2023 to January 2024. The pace of that positive rent growth is also accelerating, with rents up 0.6 percent month-over-month in March, after increasing by 0.2 percent in February.

On a year-over-year basis, rent growth nationally remains in negative territory at -0.8 percent. Year-over-year rent growth dipped below zero last June for the first time since early 2021, and has now been negative for ten consecutive months. After prices skyrocketed in 2021 and 2022, the pendulum has swung back a bit over the past year as price growth has been kept in check by sluggish demand colliding with a robust supply of new inventory hitting the market. That said, the recent dip does not equate to a reversal of the earlier price hikes – the national median rent is still 19 percent higher than it was three years ago.

[A]fter bottoming out in October 2021, vacancies have been opening up steadily for over two years. As of March, our vacancy index sits at 6.7 percent, the highest reading since June 2020. And there’s good reason to expect that it could rise even further in the year ahead. Despite a recent slowdown in new permits being issued and new construction projects breaking ground, the number of multifamily units under construction remains near record levels. …

emphasis added

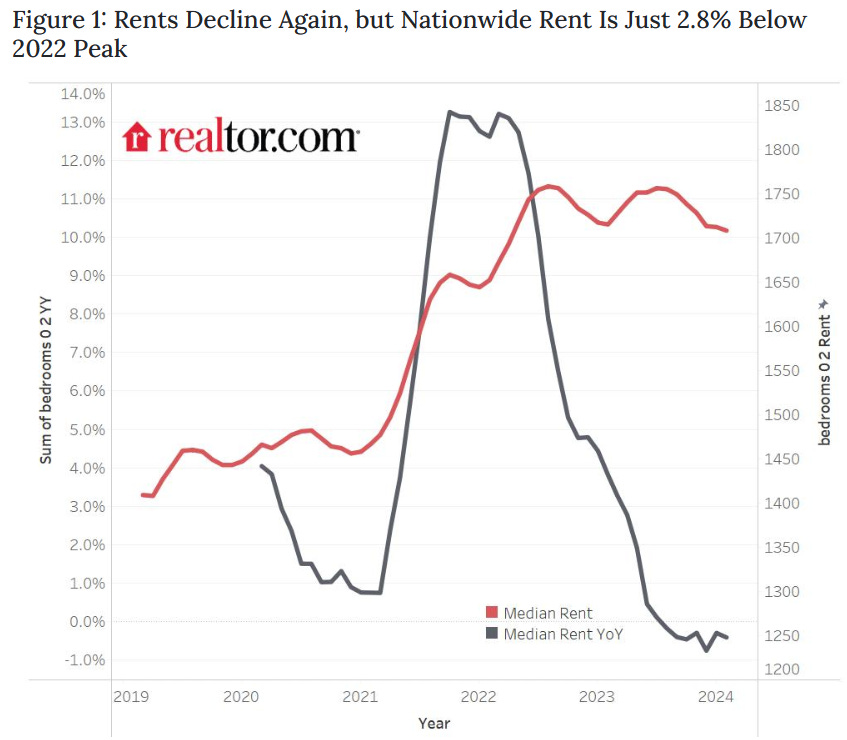

Realtor.com: Seventh Consecutive Month with Year-over-year Decline in Rents

From Realtor.com: February 2024 Rental Report: Renting a Starter Home Is More Affordable Than Buying One in Top 50 metros

In February 2024, the U.S. median rent continued to decline year over year for the seventh month in a row, down 0.4% for 0-2 bedroom properties across the top 50 metros, a pace similar to the -0.3% seen in January 2024. The median asking rent was $1,708, down by $4 from last month.

Despite the seven months of decline, the U.S. median rent was just $50 (-2.8%) less than the peak seen in August 2022. Notably, it was still $252 (17.3%) higher than the same time in 2020 (before the COVID-19 pandemic).

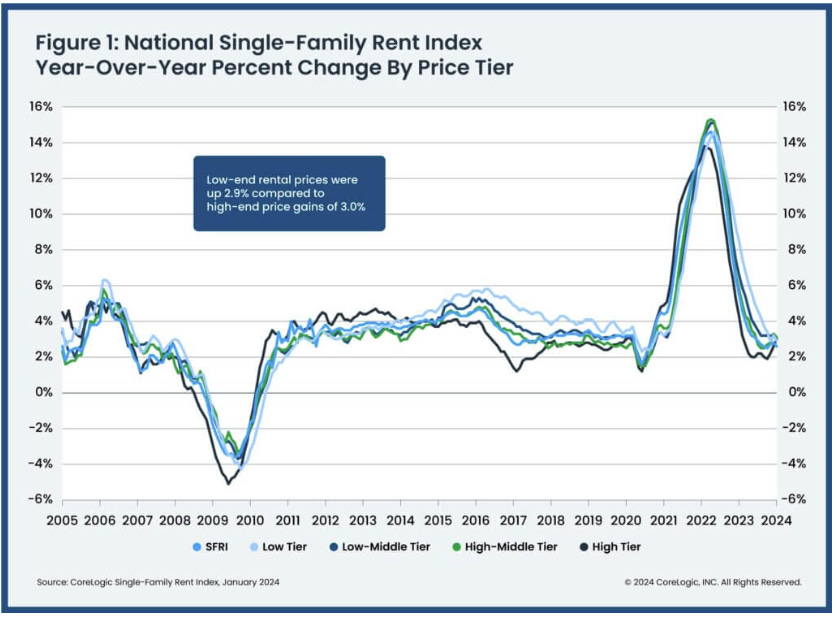

CoreLogic: “Single-family rental costs increased by 2.6% year over year”

CoreLogic also tracks rents for single family homes: US Year-Over-Year Rent Growth Holds at Less Than 3% in January, CoreLogic Reports

U.S. single-family rental costs increased by 2.6% year over year in January 2024, compared with the 5.5% gain recorded in January 2023. …

The 2.6% YoY increase in January was down from 2.8% YoY in December.

Real Page: “Unchanged rate in the previous 11 months”

From Real Page: Apartment Rent Growth Remains Aloof in February as Occupancy Stabilizes

U.S. apartment rents continued to tick up on a negligible basis in February. Asking rents for professionally managed apartments inched up just 0.2% in the year-ending February 2024, with change measured on a same-store basis, according to data from RealPage Market Analytics. On a monthly basis, rents also ticked up 0.2%, indicating that monthly rent change added up to a collectively unchanged rate in the previous 11 months.

Rent Data

Here is a graph of several measures of rent since 2000: OER, rent of primary residence, Zillow Observed Rent Index (ZORI), ApartmentList.com and CoreLogic Single Family Rental Index (All set to 100 in January 2017)

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.