Another monthly update on rents.

Tracking rents is important for understanding the dynamics of the housing market. Slower household formation and increased supply (more multi-family completions) has kept asking rents under pressure.

Apartment List: Asking Rent Growth -0.5% Year-over-year

From ApartmentList.com: Apartment List National Rent Report

Rents are down 0.6% month-over-month, down 0.6% year-over-year

Welcome to the February 2025 Apartment List National Rent Report. Our national rent index started the year with its sixth straight month-over-month decline, falling by 0.2 percent in January. Year-over-year growth also remains negative at -0.5 percent, but is slowly inching back toward positive territory. In dollar terms, the national median monthly rent now stands at $1,370, down $3 per month compared to last, and down $7 compared to January 2024.

Since the second half of 2022, rent prices have continued to ebb and flow with the seasons as they typically do, but with the overall trajectory trending modestly downward. Following a period of record-setting rent growth in 2021 and the first half of 2022, the national median rent has now fallen below its August 2022 peak by a total of 5 percent, or $72 per month. But despite the cooldown, the typical rent price remains nearly 20 percent higher than its January 2021 level.

On the supply side of the rental market, our national vacancy index ticked up to 6.9 percent in January, the highest reading in the history of that monthly data series, which goes back to the start of 2017. After a historic tightening in 2021, multifamily occupancy has been slowly but consistently easing for over three years amid an influx of new inventory. 2024 saw the most new apartment completions since the mid-1980s, and with nearly 800 thousand units still in the construction pipeline, the supply boom has runway to continue into 2025.

Realtor.com: 17th Consecutive Month with Year-over-year Decline in Rents

From Realtor.com: December 2024 Rental Report: Rents Continue To Fall as New Construction Outpaces Demand

In December 2024, the US median asking rent continued to decline month-over-month for the seventeenth consecutive month. The national median rent was $1,695 in December, down $8 (0.5%) from November 2024 and $18 (1.1%) from December 2023 across the 50 largest metropolitan areas in the country.

Though the rent declines over the past year and five months have been consistent, they haven’t amounted to major relief from the peak level reached in July 2022. December’s figure is just 3.7% below that all-time high and still 16.0% above the mark from December 2019.

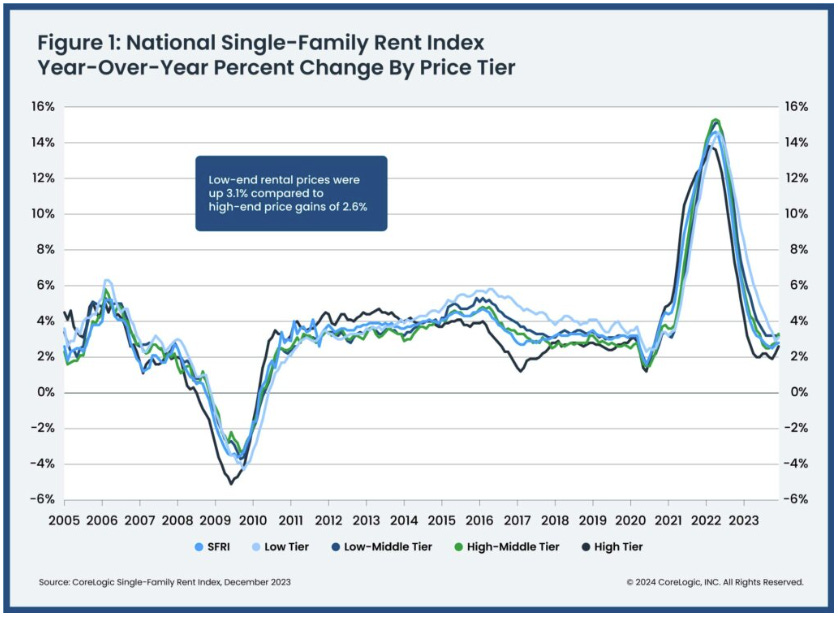

CoreLogic: Lowest Annual Rent Growth in more than 14 years

CoreLogic also tracks rents for single family homes: US Annual Single-Family Rent Growth Dips Below 2% in November

U.S. single-family rent growth slowed to 1.5% year over year in November 2024, the lowest annual increase recorded in more than 14 years. …

“Single-family annual rent growth slowed in November to the lowest rate in about 14 years. Wage growth outpaced single-family rent growth for much of the past two years which kept rent growth in positive territory,” said CoreLogic senior principal economist Molly Boesel. “Despite the recent slowdown in rent growth demand for rentals should remain strong as wage and job growth are anticipated to remain strong this year.”

The 1.5% YoY increase for single-family homes in November was down from 1.7% YoY in October.

Rent Data

The following content is for paid subscribers only. Thanks to all paid subscribers!

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.