Asking Rents Mostly Unchanged Year-over-year

Another monthly update on rents.

Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand). Now that household formation has slowed, and multi-family completions have increased, rents are under pressure.

First, a survey of rent reports …

Apartment List: Asking Rent Growth -1% Year-over-year

From ApartmentList.com: Apartment List National Rent Report

Welcome to the February 2024 Apartment List National Rent Report. The rental market kicked off the new year with a sixth straight month of negative rent growth, as the nationwide median rent fell by 0.3 percent to $1,373.1 The recent declines are in line with the rental market’s typical seasonal pattern, as fewer renters are looking to move in the fall and winter, although this year’s dip has been a bit sharper and more prolonged than what we normally see.

Year-over-year rent growth has bottomed out but remains in negative territory at -1 percent, meaning that on average, apartments across the country are slightly cheaper today than they were one year ago. This stands in sharp contrast to the prevailing conditions of 2021 and 2022, when rent prices were surging and year-over-year growth peaked at 18 percent nationally. But despite this cooldown, the national median rent is still more than $200 per month higher than it was just three years ago. …

January’s dip was relatively modest compared to the declines we’ve been seeing in recent months, indicating that we’re approaching the end of the market’s slow season. … On a year-over-year basis, rents nationally are down 1 percent. Year-over-year rent growth dipped below zero last June for the first time since the early stages of the pandemic, and has now been in negative territory for eight consecutive months. …

[A]fter bottoming out in October 2021, our national vacancy index has now been easing steadily for over two years. This easing has plateaued in recent months, but has not stopped entirely. As of January, our vacancy index sits at 6.5 percent, the highest reading since September 2020. And there’s good reason to expect that it could rise even further in the year ahead. …

emphasis added

Realtor.com: Eighth Consecutive Month with Year-over-year Decline in Rents

From Realtor.com: December 2023 Rental Report: Rent Prices Decline for Eighth Consecutive Month

In December 2023, the U.S. median rent continued to see a year-over-year decline for the eighth month in a row, down -0.4% for 0-2 bedroom properties across the top 50 metros, a pace slightly slower than the -0.6% seen in November. The median asking rent was $1,713, down by $4 from last month and $63 (-3.5%) less than the peak seen in July 2022. However, it was still $309 (22.0%) higher than the same time in 2019 (pre-pandemic).

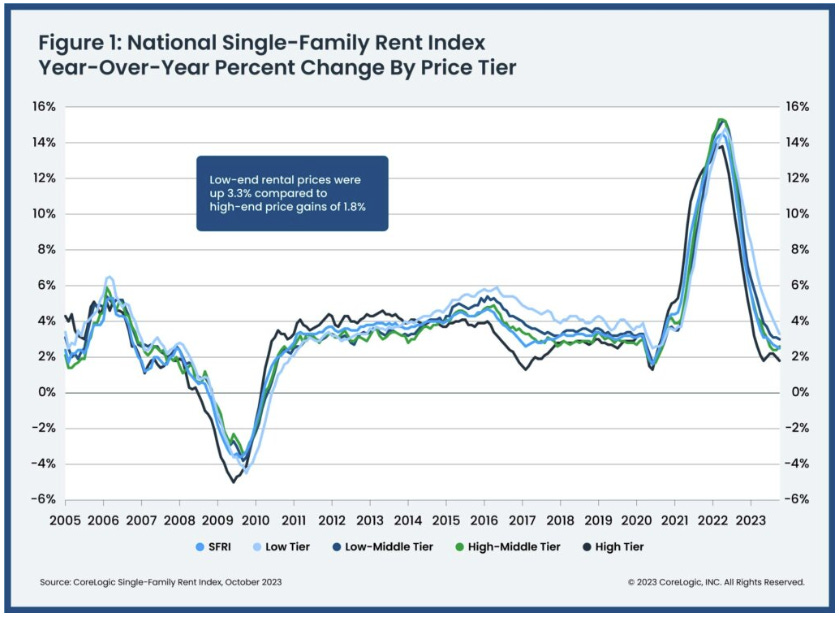

CoreLogic: “Single-family rent growth remained stable”

CoreLogic also tracks rents for single family homes: US Annual Rent Growth Holds at Less Than 3% in November, CoreLogic Reports

National single-family rent growth remained stable in November at 2.7%, slower than the double-digit gains seen in recent years but generally in line with the annual rate recorded before the pandemic. …

The 2.7% YoY increase in November was up from 2.5% in October.

Real Page: “Apartment Occupancy Hits Decade Low”

From Real Page: U.S. Apartment Occupancy Hits Decade Low

U.S. apartment occupancy hit a 10-year low at the end of 2023, as sizable new supply volumes weighed on market fundamentals. … At 94.1%, December 2023 occupancy was the lowest the nation has recorded since January 2014, when the rate was also at 94.1%, according to data from RealPage Market Analytics. December 2023 occupancy registered more than 100 basis points (bps) behind the nation’s decade average of 95.4%.

Rent Data

Here is a graph of several measures of rent since 2000: OER, rent of primary residence, Zillow Observed Rent Index (ZORI), ApartmentList.com and CoreLogic Single Family Rental Index (All set to 100 in January 2017)

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.