Another monthly update on rents.

Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand). Now that household formation has slowed, and multi-family completions have increased, rents are under pressure.

Apartment List: Asking Rent Growth -0.8% Year-over-year

From ApartmentList.com: Apartment List National Rent Report

Rents are up 0.5% month-over-month, down 0.8% year-over-year

Rent growth follows a seasonal pattern – rent increases generally take place during the spring and summer, whereas the fall and winter usually see a modest price dip. We are currently transitioning into the busy season, with the national median rent increasing for the third straight month, following six consecutive monthly declines from August 2023 to January 2024. However, the pace of that positive rent growth slowed slightly this month, with rents up 0.5 percent month-over-month in April, after increasing by 0.6 percent in March.

Realtor.com: Eighth Consecutive Month with Year-over-year Decline in Rents

From Realtor.com: March 2024 Rental Report: Median Asking Rents Continue To Decline

In March 2024, the U.S. median rent continued to decline year over year for the eighth month in a row, down -0.3% for 0-2 bedroom properties across the top 50 metros, a pace similar to the -0.4% seen in February 2024. The median asking rent was $1,722, up by $14 from last month following a typical seasonal trend.

Despite the eight months of decline, the U.S. median rent was just $36 (-2.0%) less than the peak in August 2022. Notably, it was still $313 (22.2%) higher than the same time in 2019 (before the COVID-19 pandemic).

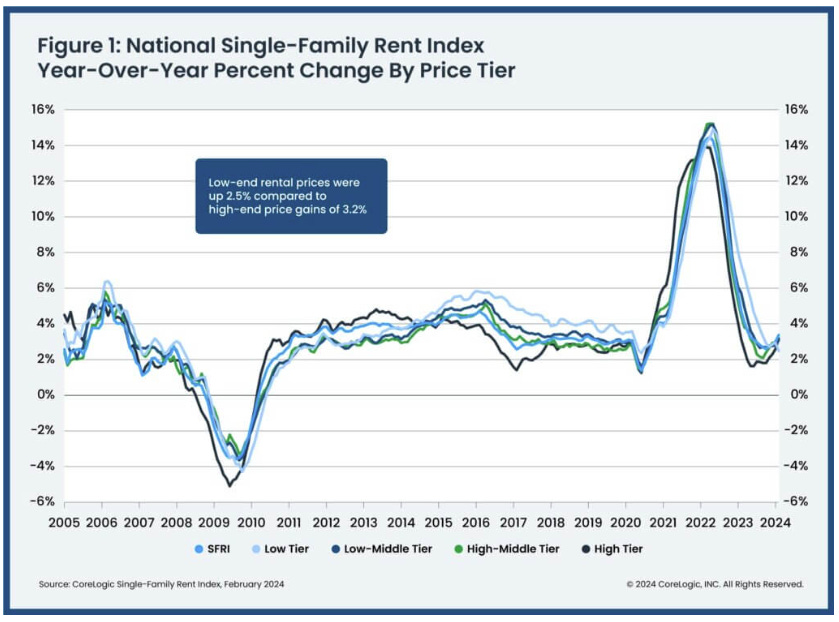

CoreLogic: “Single-family rental costs increased by 2.6% year over year”

CoreLogic also tracks rents for single family homes: CoreLogic: February US Rent Growth Posts Highest Annual Increase Since Spring 2023

U.S. single-family rents rose by 3.4% year over year in February, the strongest growth recorded in 10 months …

The 3.4% YoY increase in February was up from 2.6% YoY in January and the largest YoY increase in 10 months.

Real Page: “Apartment Rent Change Remains Tepid”

From Real Page: Apartment Occupancy Ticks Up for the First Time Since Early 2022

Apartment rent change, meanwhile, remained restrained under the pressure of new supply. Effective asking rents for professionally managed apartments ticked up just 0.2% month-over-month, keeping the year-over-year figure subdued to just 0.1% growth, with change measured on a same-store basis.

Rent Data

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.