Asking Rents Mostly Unchanged Year-over-year

Another monthly update on rents.

Tracking rents is important for understanding the dynamics of the housing market. Slower household formation and increased supply (more multi-family completions) has kept asking rents under pressure for the last few years.

More recently, immigration policy has become a negative for rentals.

Apartment List: Asking Rent Growth -0.7% Year-over-year

From ApartmentList.com: Apartment List National Rent Report

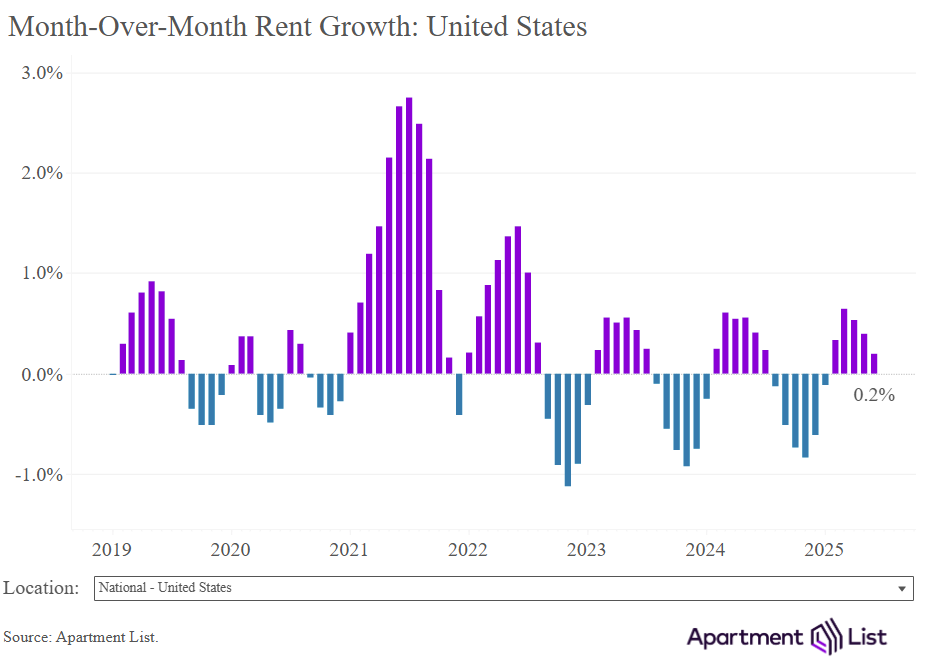

Rents are up 0.2% month-over-month, down 0.7% year-over-year

The national median rent increased by 0.2% in June and now stands at $1,401. This is the 5th consecutive month that rents have trended up, but rent growth has been slowing at the time of year when it's typically fastest.

Despite the modest increases of recent months the national median rent is still down 0.7% from where it was one year ago. Year-over-year rent growth had been close to flipping positive for the first time since 2023, but has now ticked further negative for the past two months.

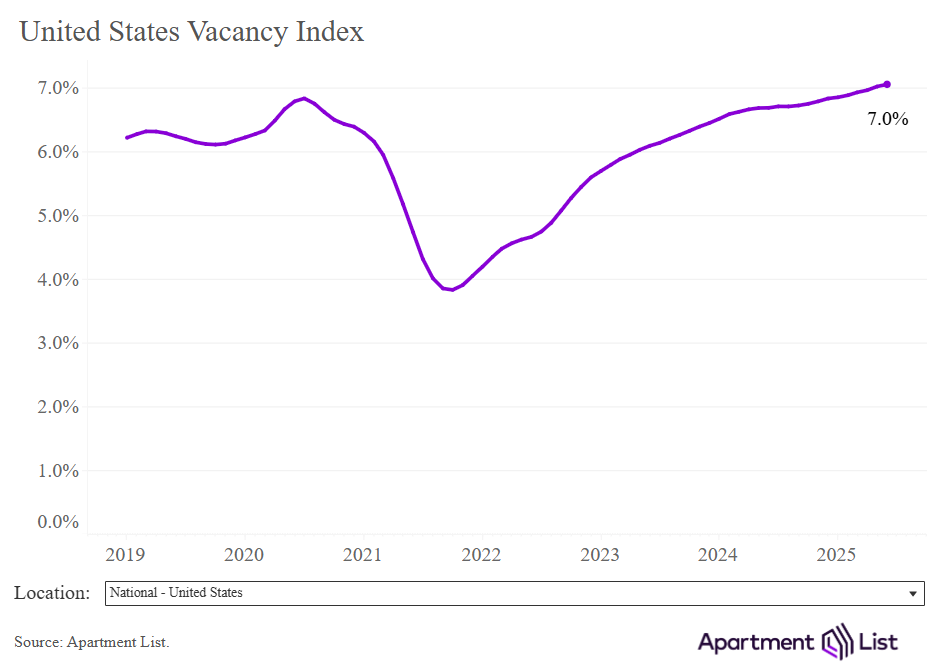

The national multifamily vacancy rate currently stands at 7%, the highest reading we've recorded in our index. We're past the peak of a multifamily construction surge, but the market is still absorbing all of the new units, and vacancies are still trending up.

Realtor.com: 22nd Consecutive Month with Year-over-year Decline in Rents

From Realtor.com: May 2025 Rental Report: Rents Continue To Decline

In May 2025, U.S. median rent posted its 22nd consecutive year-over-year decline, dropping 1.7% for 0-2 bedroom properties across the 50 largest metropolitan areas. The median asking rent stood at $1,705—just $5 higher than the previous month—reflecting a typical seasonal uptick as rents tend to rise in the spring and summer before softening in the fall and winter.

Cotality: Single Family Rents Up 2.9% year-over-year

From Cotality (formerly CoreLogic): Cotality: Single-family rent prices continued to rise in April

Compared to last April, rents were up 2.9%. Last year at this time, annual rent increases were growing at 3.1% before slowing at the end of 2024. Now, prices are trending back up to the pre-pandemic growth rate of 3.4%.

“Annual single-family rent growth mostly moved sideways in April, increasing by 2.9% year over year for the second consecutive month. Rents increased the most in the Northeast, Midwest, and Mid-Atlantic. They increased the least in the South, which is a similar pattern to home price growth. This could be an indication that the limited supply of for-sale homes, which is pushing up for-sale prices, is spilling over into the rental market as would-be buyers remain renters,” said Molly Boesel, Cotality senior principal economist.

Real Page on April Rents: Annual Rent Growth of 0.7%

From Real Page: May Occupancy Holds as Rent Recovery Falters

Occupancy in the U.S. apartment market registered at 95.7% in May, in line with last month’s reading (95.7%) and up 90 basis points (bps) year-to-date, according to data from RealPage Market Analytics. All the nation’s 50 largest apartment markets posted occupancy growth year-over-year, though about 40% of markets posted declines in the month of May.

At the same time, monthly effective rent growth reached 0.26% in May, a mild reading that registered at about half the rate seen in May 2024 (0.51%). As such, annual effective rent growth appeared to backtrack, softening from last month’s 1% reading to stand at 0.7% in May.

Zillow: Rents up 3.2% year-over-year

From Zillow: Rent Growth Cools Slightly, Following For-Sale Market’s Lead (May Rent Report)

Rent growth is slightly weaker than normal this spring and is easing, following both an injection of rental inventory and the cooling for-sale housing market. The typical asking rent has climbed to $2,049, rising 0.4% from last month and up 3.2% compared to a year ago. This is a moderation from last month’s 0.6% increase. In April, rents were 3.4% higher than the same time last year.

Rent Data

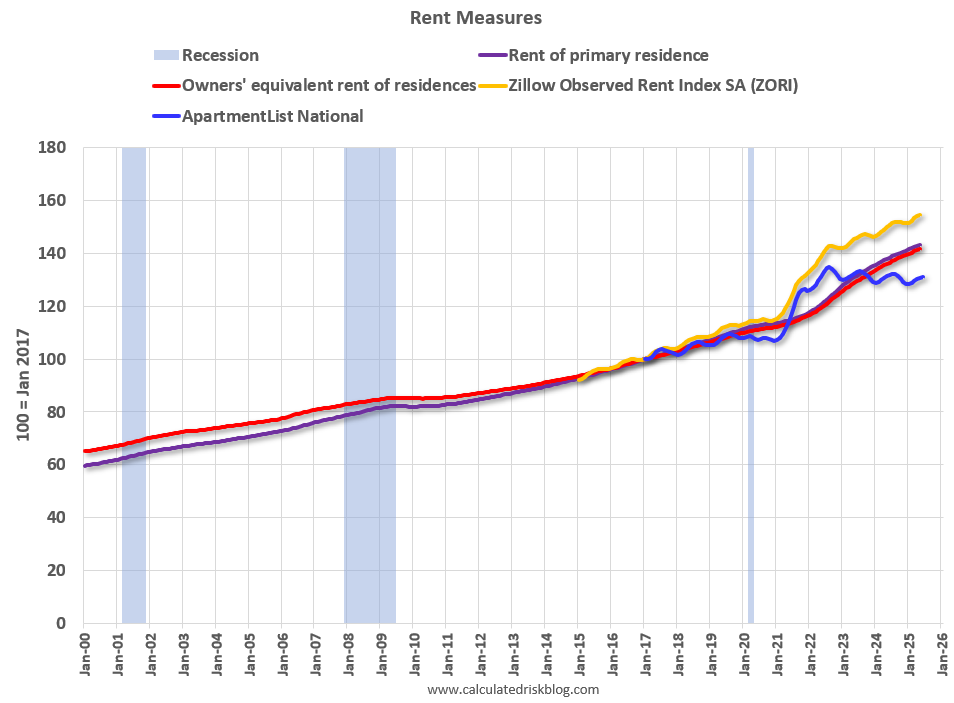

Here is a graph of several measures of rent since 2000: OER, rent of primary residence, Zillow Observed Rent Index (ZORI) and ApartmentList.com (All set to 100 in January 2017).

Note: For a discussion on how OER, and Rent of primary residence are measured, see from the BLS: How the CPI measures price change of Owners’ equivalent rent of primary residence (OER) and rent of primary residence (Rent)

OER and rent of primary residence have mostly moved together. The Zillow index started in 2015 and the ApartmentList index started in 2017.

Note that new lease measures (Zillow, Apartment List) dipped early in the pandemic, whereas the BLS measures were steady. Then new leases took off, and the BLS measures have followed.

Here is a graph of the year-over-year (YoY) change for these measures since January 2015. Most of these measures are through May 2025, except Apartment List through June 2025.

The Zillow measure (single and multi-family) is up 3.2% YoY in May, down from 3.4% YoY in April, and down from a peak of 15.7% YoY in February 2022.

The ApartmentList measure is -0.7% YoY as of June, down from -0.5% in May, and down from a peak of 17.9% YoY November 2021.

The ApartmentList measure reflects new leases, whereas most rental units don’t turnover every year (as captured by the BLS measures). The sharp increase in new lease rates in 2021 and early 2022 has been spilling over into the consumer price index (as discussed in earlier article).

The Rent of primary residence was up 3.8% YoY in May, down from 4.0% YoY in April. The Owners’ Equivalent Rent (OER) was up 4.1% YoY in May, down from 4.3% YoY in April. .

The story mostly remains the same although it might start to change later this year. There will still be a significant amount of new supply coming on the market in 2025, but the pace of new supply is declining.

However, it is possible that policy (less immigration, more deportations) could put more downward pressure on rents. The tariffs might also hurt rentals - indirectly - since renters will be paying more for other goods.

The government measures of housing inflation (CPI and PCE reports) will likely continue to slowly decline throughout 2025.