Asking Rents Mostly Unchanged Year-over-year

Another monthly update on rents.

Tracking rents is important for understanding the dynamics of the housing market. Slower household formation and increased supply (more multi-family completions) has kept asking rents under pressure.

Apartment List: Asking Rent Growth -0.4% Year-over-year

From ApartmentList.com: Apartment List National Rent Report

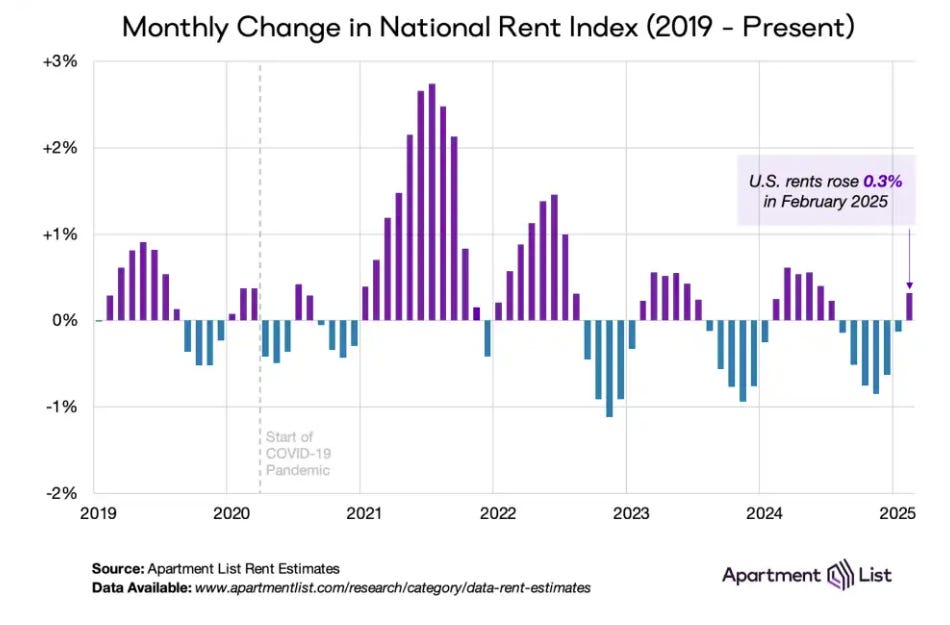

Rents are up 0.3% month-over-month, down 0.4% year-over-year

Welcome to the March 2025 Apartment List National Rent Report. Our national rent index flipped back to positive month-over-month rent growth, increasing by 0.3 percent in February following six straight monthly declines. Year-over-year growth also remains negative at -0.4 percent, but is slowly inching back toward positive territory. In dollar terms, the national median monthly rent now stands at $1,375, up $4 per month compared to last month, but down $5 compared to February 2024.

Since the second half of 2022, rent prices have continued to ebb and flow with the seasons as they typically do, but with the overall trajectory trending modestly downward. Following a period of record-setting rent growth in 2021 and the first half of 2022, the national median rent has now fallen below its August 2022 peak by a total of 4.6 percent, or $67 per month. But despite the cooldown, the typical rent price remains nearly 20 percent higher than its January 2021 level.

On the supply side of the rental market, our national vacancy index now sits at 6.9 percent, the highest reading in the history of that monthly data series, which goes back to the start of 2017. After a historic tightening in 2021, multifamily occupancy has been slowly but consistently easing for over three years amid an influx of new inventory. 2024 saw the most new apartment completions since the mid-1980s, and with nearly 800 thousand units still in the construction pipeline, the supply boom has runway to continue into 2025.

Realtor.com: 18th Consecutive Month with Year-over-year Decline in Rents

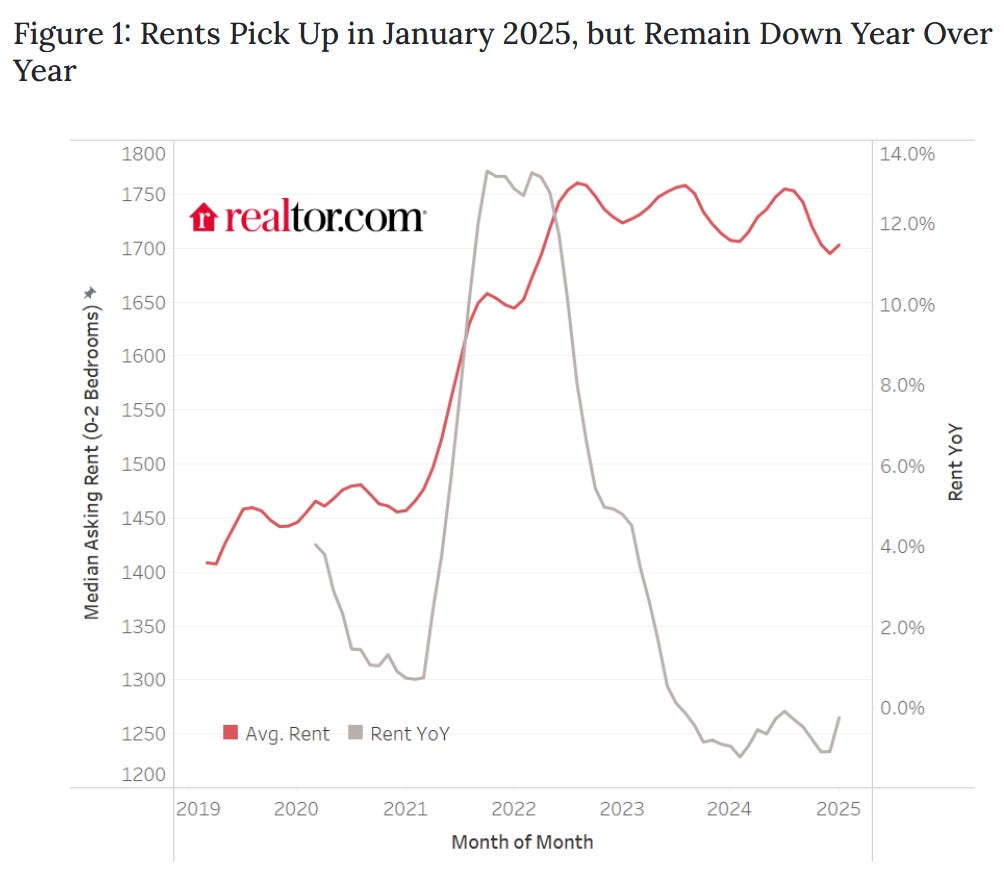

From Realtor.com: January 2025 Rental Report: Rent Steadies in January as Year-Over-Year Decline Moderates

In the first month of 2025, the median asking rent across the 50 largest U.S. metropolitan areas picked up slightly to $1,703, from $1,695 in December 2024, but it remains down 0.2% from one year ago. This marks the 18th consecutive month in which rents have fallen year over year. Rent growth has tapered off since its post-pandemic surge, but the declines have been minor. While January 2025’s rent figure is lower than both January 2024 and January 2023’s, it still exceeds January 2020 by $257 (16.1%). Even though rents are falling, renters are still feeling the pinch from the rapid rent growth of 2021 and 2022.

CoreLogic: Lowest Annual Rent Growth in 4 years

CoreLogic also tracks rents for single family homes: US Annual Single-Family Rent Growth Finished 2024 Below Long-Term Trend Rates

Single-family rent prices increased 1.8% year over year in December 2024, down from the previous month’s 2.2%, and down from December 2023, when rent prices grew 2.5%, marking the lowest annual growth rate in about four years. …

“Single-family rent growth averaged 2.6% in 2024, below the 2010-2020 average of 3.5% when rents were growing at a fairly steady rate. Growth was frontloaded and slowed throughout the year,” said CoreLogic Senior Principal Economist Molly Boesel. “Though increases were moderate, rents continue to increase, with an average increase of about $100 per year for the past five years.”

The 1.8% YoY increase for single-family homes in December was down from 2.2% YoY in November.

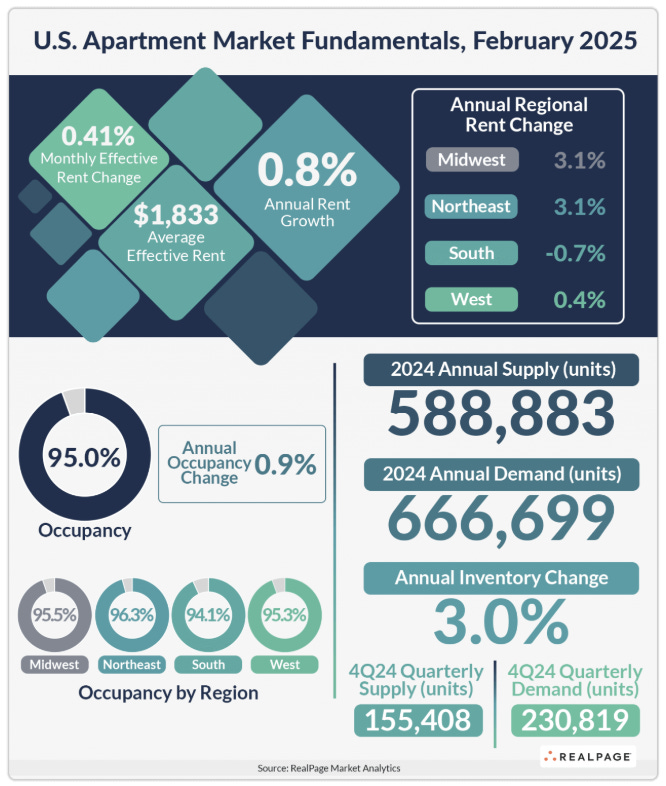

Real Page on Rents: “In the year-ending February 2025, effective asking rents in professionally managed market-rate units grew 0.8%”

From Real Page: Modest Momentum Builds in February Rent Growth, Occupancy Readings

Apartment rents in market-rate units grew 0.41% in February, according to data from RealPage Market Analytics. That rate fell below the long-term norm for February rent growth of 0.53% from 2015 to 2024 but was still the highest February reading since 2022. At the same time, the nation’s once-in-a-generation apartment supply wave is cresting, with supply dissipating more quickly in some markets than others. As the construction pipeline empties, demand rallies and operators are generally more able to realize occupancy gains and rent momentum. …

In the year-ending February 2025, effective asking rents in professionally managed market-rate units grew 0.8%. Although that rate fell easily below long-term norms, it marked the highest annual rate seen since July 2023.

Rent Data

The following content is for paid subscribers only. Thanks to all paid subscribers!

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.