Asking Rents Mostly Unchanged Year-over-year

Another monthly update on rents.

Tracking rents is important for understanding the dynamics of the housing market. For example, the sharp increase in rents helped me deduce that there was a surge in household formation in 2021 (See from September 2021: Household Formation Drives Housing Demand).

Slower household formation and increased supply (more multi-family completions) has kept asking rents under pressure.

Apartment List: Asking Rent Growth -0.7% Year-over-year

From ApartmentList.com: Apartment List National Rent Report

Rents are down 0.5% month-over-month, down 0.7% year-over-year

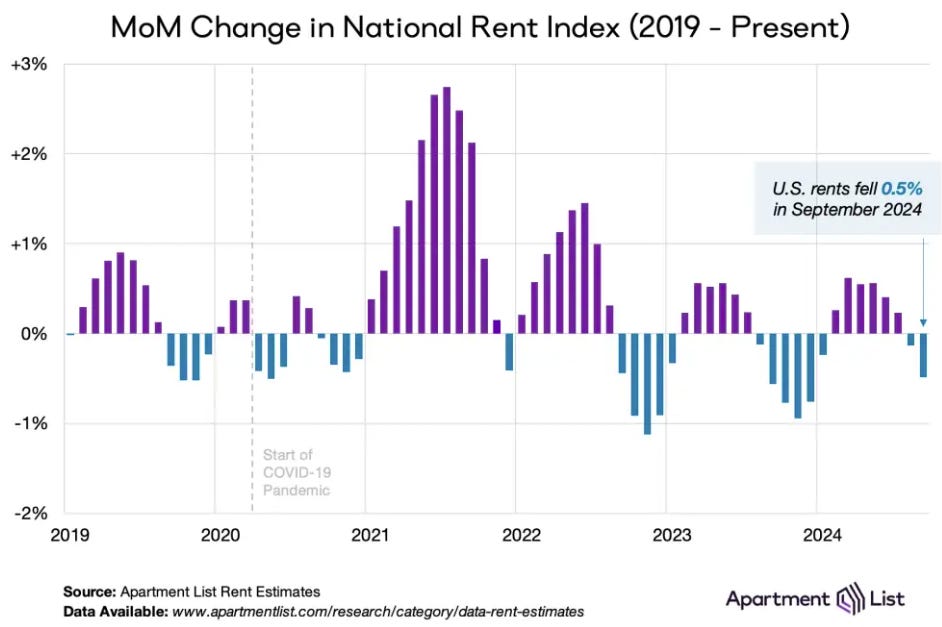

Welcome to the October 2024 Apartment List National Rent Report. The national median rent dipped by 0.5% in September, as we turn the corner into the slow season for the rental market. The median rent nationally now stands at $1,405, and we’re likely to see that number continue to dip modestly through the remainder of the year.

Since the second half of 2022, the seasonal declines in rent prices that take place during the fall and winter have been steeper than usual and seasonal increases of the spring and summer have been more mild. As a result, apartments are on average slightly cheaper today than they were one year ago. Year-over-year rent growth nationally currently stands at -0.7 percent and has now been in negative territory for over a year and a half. Despite this, the national median rent is still more than $200 per month higher than it was just a few years ago.

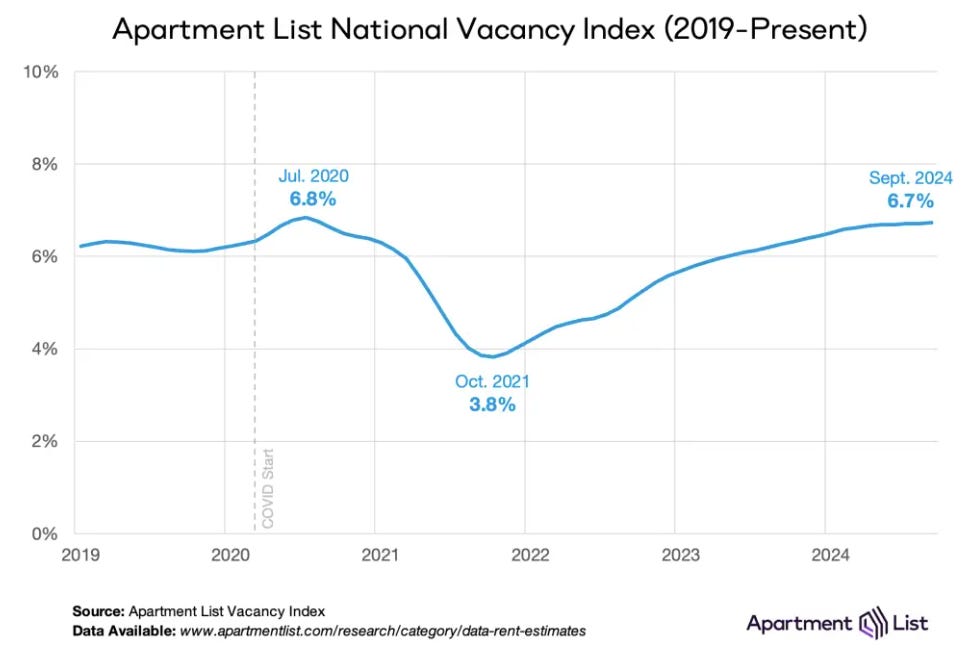

On the supply side of the rental market, our national vacancy index remains slightly elevated, currently standing at 6.7 percent. After a historic tightening in 2021, multifamily occupancy has been slowly but consistently easing for over two years. And with 2024 bringing the most new apartment completions in decades, we expect that there will continue to be an abundance of vacant units on the market in the year ahead.

Realtor.com: 13th Consecutive Month with Year-over-year Decline in Rents

From Realtor.com: August 2024 Rental Report: Rental Affordability Improved From a Year Ago

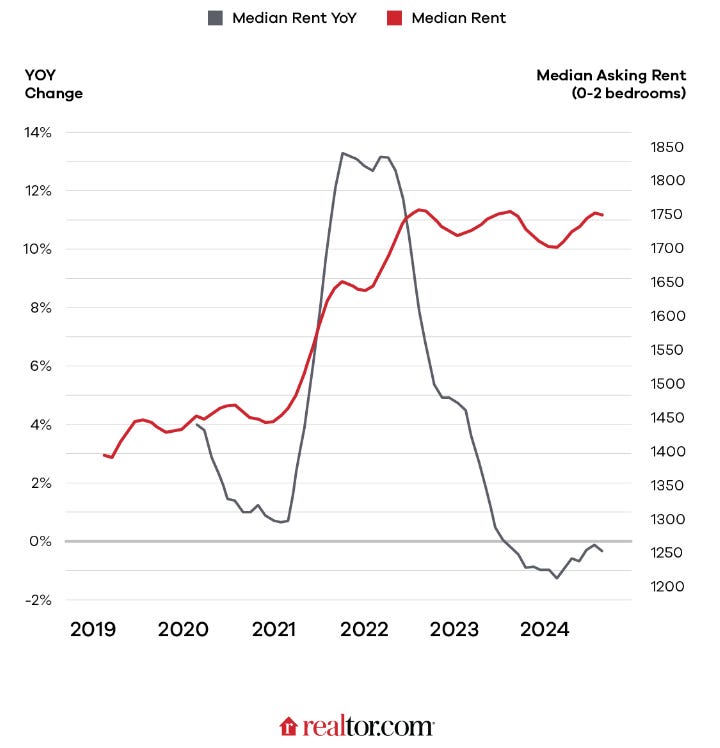

In August 2024, the U.S. median rent continued to decline year over year for the 13th month in a row, down $5, or -0.3%, year over year for 0-2 bedroom properties across the top 50 metros, slightly faster than the rate of -0.1% seen in July 2024. The median asking rent was $1,753, down by $2 from last month, reflecting a similar seasonal trend observed in the for-sale market.

Despite the 13th month of decline, the U.S. median rent was just $7 (-0.4%) less than the peak seen in August 2022. Notably, it was still $293 (20.1%) higher than the same time in 2019 (pre-pandemic), but this increase is roughly on par with what has occurred in overall consumer prices (up 22.7% in the five years ending August 2024) and pales in comparison to the 51.0% increase in median price per square foot of for-sale home listings in the five years ending July 2024. Further, the relative steadiness in rents should translate into slower shelter inflation in the months ahead, alleviating one of the biggest recent drivers of rising prices.

CoreLogic: Rents Increase 2.8% YoY for Single-Family

CoreLogic also tracks rents for single family homes: CoreLogic Reports 2.8% Year-Over-Year Single-Family Rent Growth in July 2024, Led by Washington D.C. at 6.3%

National year-over-year rent growth continues to hold steady but remains below average pre-pandemic levels. In July 2024, prices remained relatively stable, posting a 2.8% gain year over year. This represents a -0.1% drop from June 2024. By comparison, prior to 2020, single-family rent growth increased between 2% to 4% for nearly a decade, averaging 3.4%.

“On the surface, single-family rent growth in July could be characterized as ‘average,’ with the annual and monthly national changes roughly equal to long-term levels,” said Molly Boesel, principal economist for CoreLogic. “However, a deeper look reveals that rent changes slowed at the lowest end of the market, dropping 0.2% in July from a year earlier. While this drop might be due to a strong year-ago comparison, it is most likely a welcome relief to renters looking for rentals in the lower-priced end of the market.”

The 2.8% YoY increase for single-family homes in July was down from 2.9% YoY in June. The low tier declined YoY.

Real Page: “Apartment Rent Change Remains Tepid”

From Real Page: U.S. Apartment Market Sees Negligible Change in August

Rent change also remained stable for the month of August, keeping year-over-year growth modest at just 0.4%. This was well behind the nation’s decade average. In fact, annual rent growth has remained very mild – at no more than 0.4% – for the past 13 consecutive months.

Rent Data

The following content is for paid subscribers only. Thanks to all paid subscribers!

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.