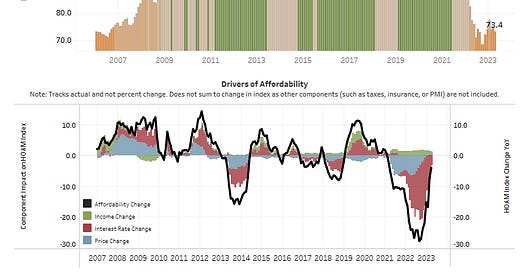

Atlanta Fed: Home Ownership Affordability Monitor

For house prices, there is an ongoing battle between low inventory and affordability. Here is another measure of affordability that readers might find useful from the Atlanta Fed: Home Ownership Affordability Monitor

To help business economists and analysts track the relative changes in home ownership affordability at a higher frequency and more granula…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.