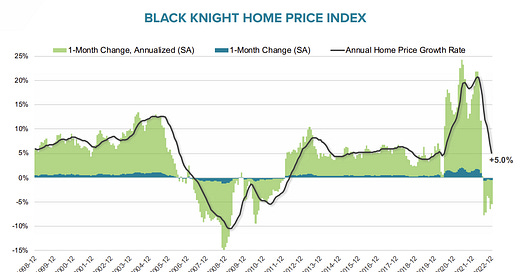

Black Knight Mortgage Monitor: Home Prices Declined in December; Down 5.3% since June

At Current Rate "annual home price growth rate [would] go negative within the next three months"

Note: The Black Knight House Price Index (HPI) is a repeat sales index. Black Knight reports the median price change of the repeat sales.

Press Release: Black Knight: 57% of Recent Borrowers Used Rate Buydowns, With A Quarter Paying Two or More Points; Purchase and Cash-Out Most Impacted

Today, the Data & Analytics division of Black Knight, Inc. (NYSE:BKI…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.