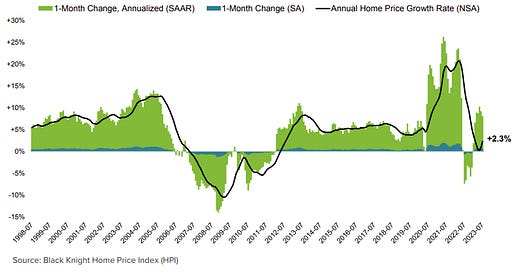

Black Knight Mortgage Monitor: Purchase Rate Locks "are now running 39% below pre-pandemic levels"

Note: Black Knight mentions the decline in cash-out refis, and I’ll have more on Mortgage Equity Withdrawal (MEW) on Friday with the release of the Fed’s Flow of Funds report (Z.1 - Financial Accounts of the United States).

Press Release: Black Knight: As Interest Rates Hit 22-Year Highs, 51% of Homebuyers Face $2,000+ Monthly Mortgage Payments; Nearly a…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.