S&P/Case-Shiller released the monthly Home Price Indices for November ("November" is a 3-month average of September, October and November closing prices). November closing prices include some contracts signed in July, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.44% (a 5.3% annual rate), This was the 22nd consecutive MoM increase in the seasonally adjusted index.

On a seasonally adjusted basis, prices increased month-to-month in 18 of the 20 Case-Shiller cities (prices declined in Seattle and Tampa seasonally adjusted). San Francisco has fallen 6.42% from the recent peak, Phoenix is down 2.1% from the peak, and Denver down 1.7%.

FHFA House Price Index

On the FHFA index: FHFA House Price Index Up 0.3 Percent in November; Up 4.2 Percent from Previous Year

U.S. house prices rose 0.3 percent in November, according to the Federal Housing Finance Agency (FHFA) seasonally adjusted monthly House Price Index (HPI®). House prices rose 4.2 percent from November 2023 to November 2024. The previously reported 0.4 percent price growth in October was revised upward to 0.5 percent.

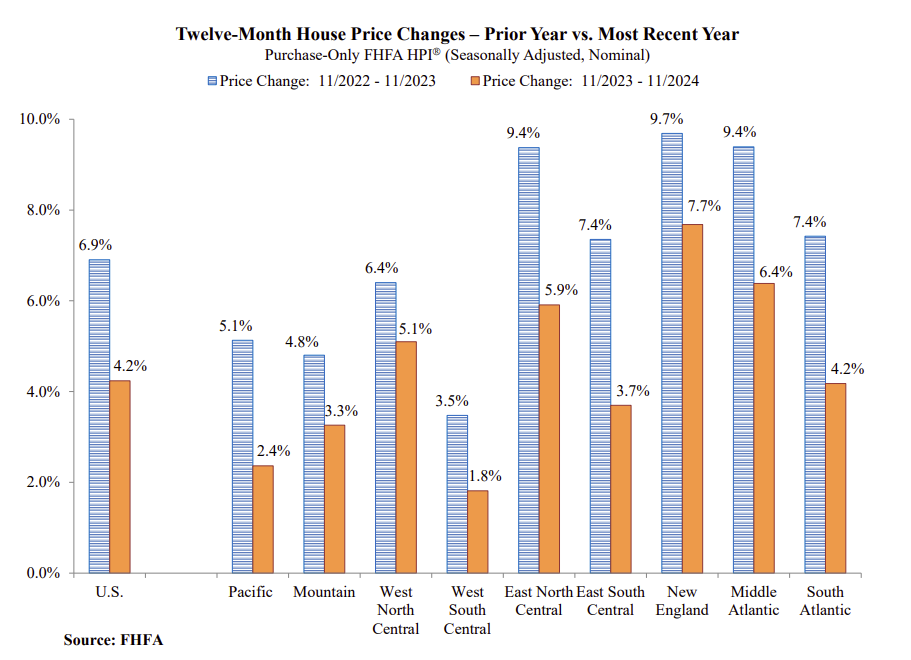

However, in a repeat of previous HPI updates, price growth both nationally and regionally showed signs of slowing. The 12-month growth rate in November was 2.7 percentage points lower than it was as of November 2023, the fourth straight month in which the year-over-year growth rate was lower than it had been a year earlier.

“Annual house price gains continued to moderate in November, with sales prices in all nine Census divisions exhibiting slower pace of growth than a year earlier,” said Dr. Anju Vajja, Deputy Director for FHFA’s Division of Research and Statistics. “The slowdown in price growth is likely due to higher mortgage rates contributing to cooling demand.”

emphasis added

The seasonally adjusted monthly index increased 0.3% in November. Here is a graph from the FHFA report showing the annual change by region for November 2024 compared to November 2023. Prices have increased year-over-year in all regions. Note that the YoY increase is smaller this year, compared to the YoY increase in November 2023 in all of the nine regions.

Case-Shiller House Prices

From S&P S&P CoreLogic Case-Shiller Index Records 3.8% Annual Gain in November 2024

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 3.8% annual return for November, up from a 3.6% annual gain in the previous month. The 10-City Composite saw an annual increase of 4.9%, recording the same annual increase in the previous month. The 20-City Composite posted a year-over-year increase of 4.3%, up from a 4.2% increase in the previous month. New York again reported the highest annual gain among the 20 cities with a 7.3% increase in November, followed by Chicago and Washington with annual increases of 6.2% and 5.9%, respectively. Tampa posted the lowest return, falling 0.4%.

...

The pre-seasonally adjusted U.S. National, 20-City, and 10-City Composite Indices’ upward trends continued to reverse in November, with a -0.1% drop for the national index, while the 20-City Composite saw a -0.1% decline and the 10-City Composite was unchanged.

After seasonal adjustment, the U.S. National, 20-City, and 10-City Composite Indices all posted a month-over-month increase of 0.4%.

“With the exception of pockets of above-trend performance, national home prices are trending below historical averages,” says Brian D. Luke, CFA, Head of Commodities, Real & Digital Assets. “Markets in New York, Washington, D.C., and Chicago are well above norms, with New York leading the way. Unsurprisingly, the Northeast was the fastest growing region, averaging a 6.1% annual gain. However, markets out west and in once red-hot Florida are trending well below average growth. Tampa’s decline is the first annual drop for any market in over a year. Returns for the Tampa market and entire Southern region rank in the bottom quartile of historical annual gains, with data going back to 1988.

“Despite below-trend growth, our National Index hit its 18th consecutive all-time high on a seasonally adjusted basis,” Luke continued. “Again, with the exception of Tampa, all markets rose monthly with seasonal adjustment. With New York leading the nation for the seventh consecutive month and U.S. banks reporting strong Q4 earnings, this could set the Big Apple up as we close out the year.”

emphasis added

This graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index was up 0.4% in November (SA). The Composite 20 index was up 0.4% (SA) in November. The National index was up 0.4% (SA) in November.

The Composite 10 SA was up 4.9% year-over-year. The Composite 20 SA was up 4.3% year-over-year. The National index SA was up 3.8% year-over-year.

And a few things to watch …

The following content is for paid subscribers only. Thanks to all paid subscribers!

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.