Case-Shiller: National House Price Index Up 6.0% year-over-year in January

FHFA: House Prices Declined Slightly in January, up 6.3% YoY

S&P/Case-Shiller released the monthly Home Price Indices for January ("January" is a 3-month average of November, December and January closing prices). January closing prices include some contracts signed in September, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.36%. This was the twelfth consecutive MoM increase, and a larger MoM increase than the previous two months.

On a seasonally adjusted basis, prices increased month-to-month in 13 of the 20 Case-Shiller cities. Seasonally adjusted, San Francisco has fallen 8.4% from the recent peak, Seattle is down 7.1% from the peak, Portland down 4.8%, and Phoenix is down 3.6%.

FHFA House Price Index

On the FHFA index: FHFA House Price Index Down 0.1 Percent in January; Up 6.3 Percent from Last Year

U.S. house prices fell in January, down 0.1 percent from December, according to the Federal Housing Finance Agency (FHFA) seasonally adjusted monthly House Price Index (HPI®). House prices rose 6.3 percent from January 2023 to January 2024. The previously reported 0.1 percent price increase in December remained unchanged.

For the nine census divisions, seasonally adjusted monthly price changes from December 2023 to January 2024 ranged from -0.6 percent in the South Atlantic division to +1.5 percent in the West North Central division. The 12-month changes were all positive, ranging from +3.8 percent in the West South Central division to +8.7 percent in the East North Central division.

“U.S. house prices declined slightly in January, marking the first decrease since August 2022,” said Dr. Anju Vajja, Deputy Director for FHFA’s Division of Research and Statistics. “However, the year-over-year house price growth remained near the historical average.”

emphasis added

The seasonally adjusted monthly index decreased 0.1% in January. Here is a graph from the FHFA report showing the annual change by region for January 2024 compared to January 2023. Prices have increased year-over-year everywhere. Note that the YoY increase is larger this year, compared to the YoY increase in January 2023 in six of the nine regions.

The increase this year is smaller in the West South Central, East South Central and South Atlantic regions.

Case-Shiller House Prices

From S&P S&P CoreLogic Case-Shiller Index Continues to Trend Upward in January 2024

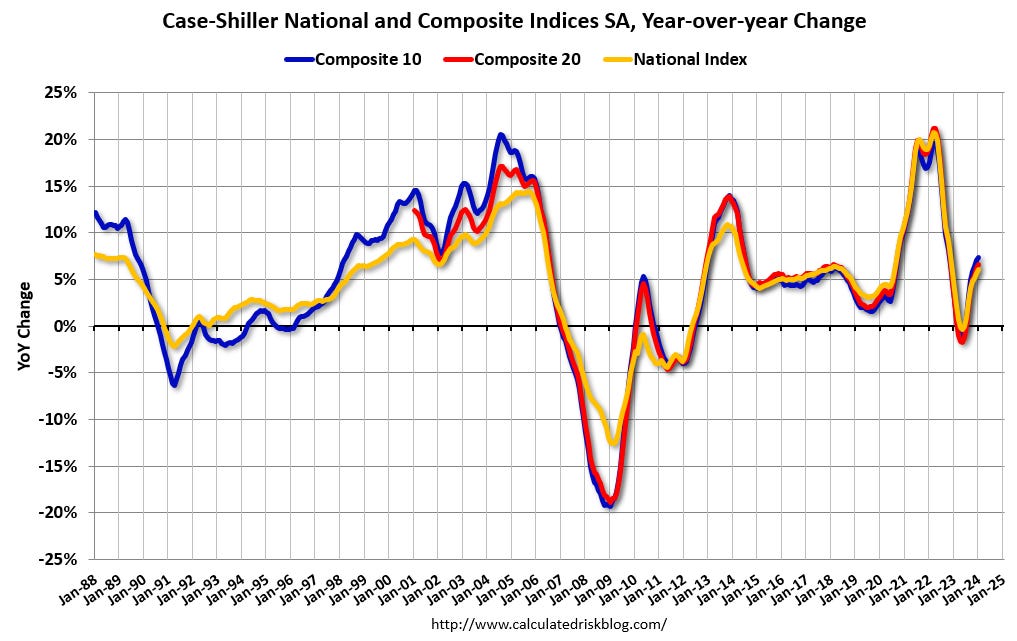

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.0% annual gain in January, up from a 5.6% rise in the previous month. The 10- City Composite showed an increase of 7.4%, up from a 7.0% increase in the previous month. The 20- City Composite posted a year-over-year increase of 6.6%, up from a 6.2% increase in the previous month. San Diego again reported the highest year-over-year gain among the 20 cities with an 11.2% increase in January, followed by Los Angeles, with an increase of 8.6%. Portland, though holding the lowest rank after reporting the smallest year-over-year growth, retained an upward trend with a 0.9% increase this month.

...

The U.S. National Index and the 20-City Composite showed a continued decrease of 0.1%, and 10-City Composite remained unchanged in January.

After seasonal adjustment, the U.S. National Index, the 20-City Composite, and the 10-City Composite all posted month-over-month increases of 0.4%, 0.1%, and 0.2% respectively.

“U.S. home prices continued their drive higher,” says Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. “Our National Composite rose by 6% in January, the fastest annual rate since 2022. Stronger gains came from our 10- and 20-City Composite indices, rising 7.4% and 6.6%, respectively. For the second consecutive month, all cities reported increases in annual prices, with San Diego surging 11.2%. On a seasonal adjusted basis, home prices have continued to break through previous all-time highs set last year”

emphasis added

This graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

Note: Prices declined NSA but increased seasonally adjusted.

The Composite 10 index is up 0.2% in January (SA). The Composite 20 index is up 0.1% (SA) in January. The National index is up 0.4% (SA) in January.

The Composite 10 SA is up 7.4% year-over-year. The Composite 20 SA is up 6.6% year-over-year. The National index SA is up 6.0% year-over-year.

And a few things to watch …

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.