Case-Shiller National Index up 18.8% Year-over-year in November

FHFA: "House price levels remained elevated in November, but the data indicate a pivot"

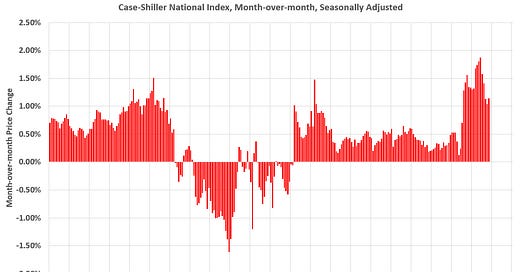

Both the Case-Shiller House Price Index (HPI) and the Federal Housing Finance Agency (FHFA) HPI for November were released today. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in Case-Shiller was at 1.14%; still historically high, but lower than the increases in the 2nd …

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.