There have been three recent key changes in the housing market:

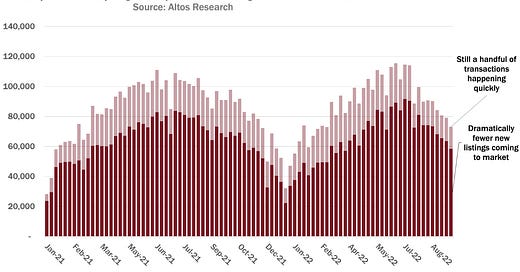

New listings have declined significantly year-over-year.

This “Sellers’ Strike” has led to inventory growth stalling.

And homeowners have continued to borrow against their home equity, shifting from cash-out refinance to home equity loans (so they can keep their low interest 1st mortgage).

New …

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.