Over the last month …

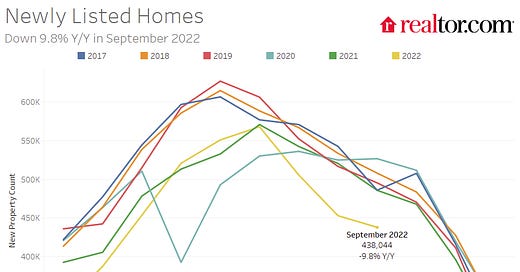

New listings have declined further year-over-year.

Mortgage rates have increased further pushing monthly payments up sharply.

House prices have started to decline month-over-month (MoM) as measured by the repeat sales indexes.

New Listing Have Declined Significantly

Here is a graph of new listing from Realtor.com’s September Housing Tre…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.