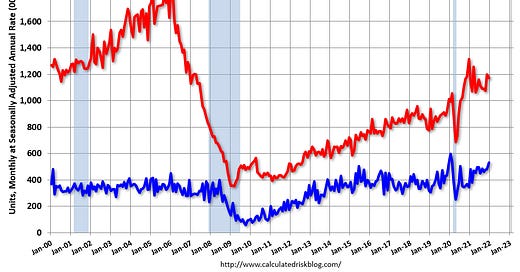

December Housing Starts: Most Housing Units Under Construction Since 1973

Housing Starts Increased to 1.702 million Annual Rate in December

From the Census Bureau: Permits, Starts and Completions

Special Note: Permits were distorted in December: “In December, there was a large increase in building permits issued in Philadelphia, PA. Philadelphia enacted several real estate tax changes for residential projects permitted after December 31, 2021.”

Housing Starts:

Privately‐owned housing starts in…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.