Fannie and Freddie: Single-Family Mortgage Delinquency Rate Declined, Multi-Family Increased in June

CoreLogic: Mortgage Delinquency Rate Drops to All-Time Low in May

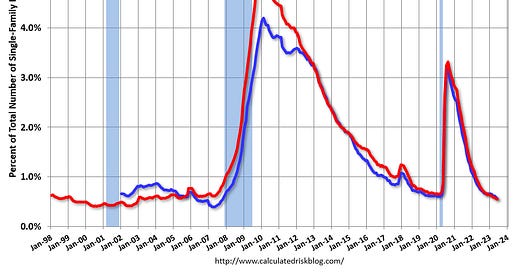

I’ve argued that there would not be a huge wave of single-family foreclosures this cycle since lending standards have been solid and most homeowners have substantial equity. That means we will not see cascading price declines like following the housing bubble. This is a high confidence prediction and is supported by the following data.

However, there …

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.