Here are some graphs on outstanding mortgages by interest rate, the average mortgage interest rate, borrowers’ credit scores and current loan-to-value (LTV) from the FHFA’s National Mortgage Database through Q2 2023 (released last Friday).

Current Outstanding Mortgage Rates

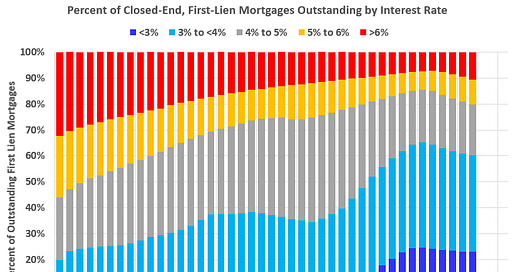

Here is some data showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q2 2023.

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. The percent of outstanding loans under 4% peaked in Q1 2022 at 65.3%, and the percent under 5% peaked at 85.6%. These low existing mortgage rates makes it difficult for homeowners to sell their homes and buy a new home since their monthly payments would increase sharply. This is a key reason existing home inventory levels are so low.

The percent of loans over 6% bottomed in Q2 2022 at 7.1% and has increased to 10.5% in Q2 2023.

And here is another way to look at the data. Yesterday, ICE (formerly Black Knight) released their monthly mortgage monitor and included this graph of active mortgages by interest rate.

Note the higher mortgage rates for the 2023 vintage - still a small portion of the overall market. A large portion of active mortgages are in the 2020-2022 vintages when mortgage rates were below 4%.

Here are graphs on the average mortgage interest rate, borrowers’ credit scores and current loan-to-value (LTV) from the FHFA data base.

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.