In 2021 there was a sharp increase in rents. This was due to a surge in household formation during the pandemic. Over time, housing economist Tom Lawler and I unraveled the household formation mystery in a series of articles (links at the bottom of this post).

This analysis led to the conclusion that household formation would slow sharply, and that asking rents would likely turn negative year-over-year (both have happened). The next likely consequence is that multifamily starts will decline significantly.

Here are several data points supporting this forecast.

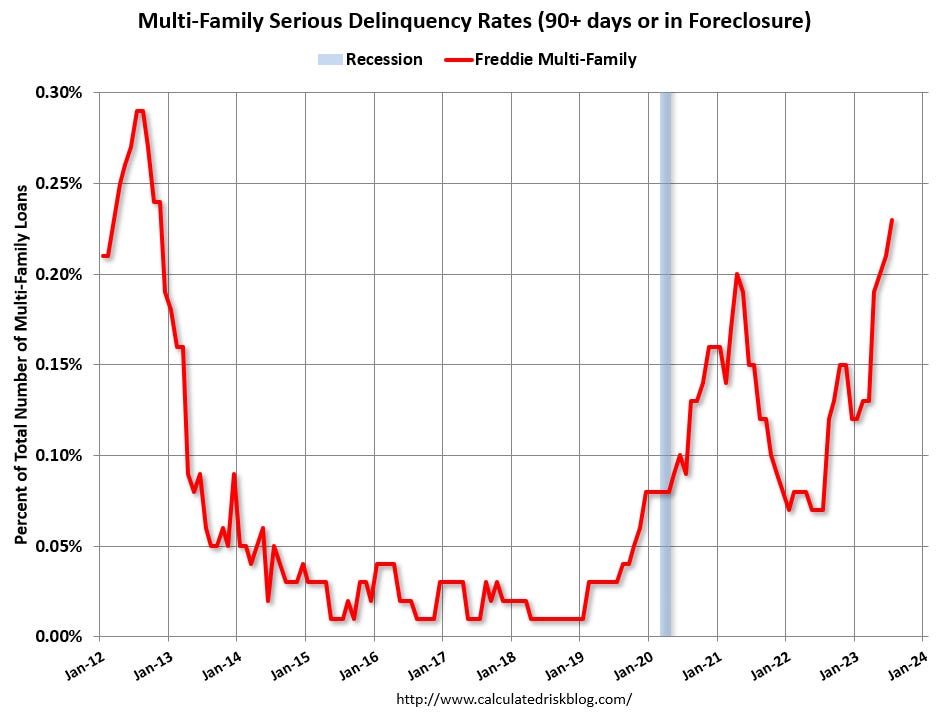

Freddie: Multifamily Delinquencies Have Tripled Year-over-year

Freddie Mac reports that multifamily delinquencies increased to 0.23% in July, up from 0.07% in July 2022.

This graph shows the Freddie multi-family serious delinquency rate since 2012. Rates were still high in 2012 following the housing bust and financial crisis.

The multi-family delinquency rate increased following the pandemic and then recovered as rents soared. The rate has increased recently as asking rents softened, vacancy rates increased, lending has tightened, and interest rates have increased sharply.

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.