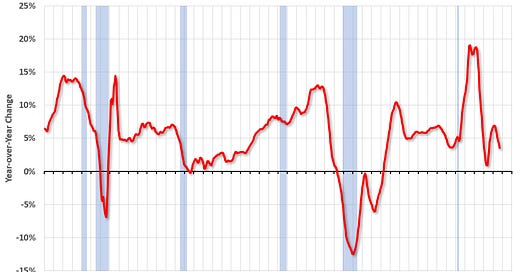

Freddie Mac House Price Index Increased in September; Up 3.6% Year-over-year

17 of the 30 worst performing cities are now in Florida!

Note: The Freddie Mac index is a repeat sales index using only loans purchased by Fannie and Freddie and includes appraisals. See FAQs here. Freddie has data for all states and many cities. For house prices, I’m currently following Case-Shiller, FHFA, CoreLogic, ICE, the NAR median prices, and this Freddie Mac index.

Freddie Mac reported that its “Nation…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.