House Price Weekend: Case-Shiller: National House Price Index Up 5.4% year-over-year in June

FHFA House Price Index Declined Slightly month-over-month in June

I'm back from Africa! I’ll be all caught up this weekend after a few house price emails.

Thanks for your patience! One last safari video of an elephant drinking at sunset.

Case-Shiller: National House Price Index Up 5.4% year-over-year in June

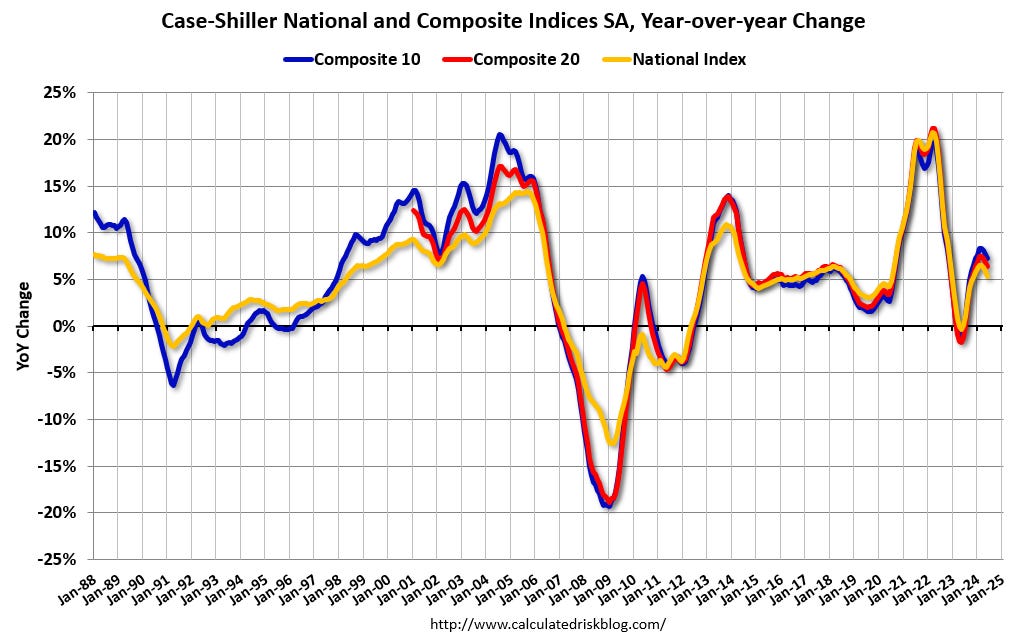

S&P/Case-Shiller released the monthly Home Price Indices for June ("June" is a 3-month average of April, May and June closing prices). June closing prices include some contracts signed in February, so there is a significant lag to this data. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in the seasonally adjusted (SA) Case-Shiller National Index was at 0.16%. This was the seventeenth consecutive MoM increase, but this was the smallest MoM increase in the last 16 months.

On a seasonally adjusted basis, prices increased month-to-month in 15 of the 20 Case-Shiller cities. Seasonally adjusted, San Francisco has fallen 6.8% from the recent peak, Phoenix is down 4.5% from the peak, Seattle down 4.0%, and Portland is down 3.4%.

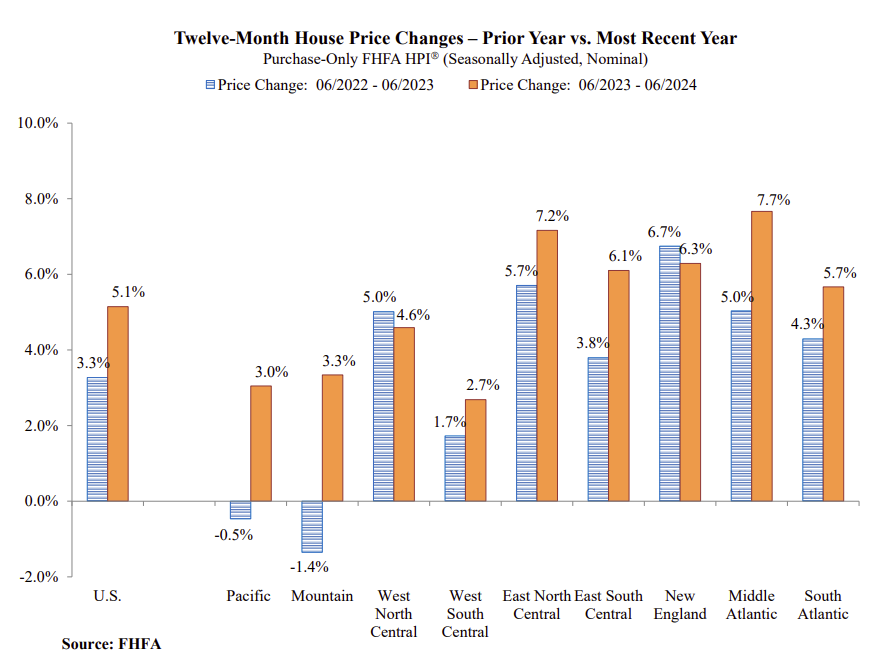

FHFA House Price Index

On the FHFA index: U.S. House Prices Rise 5.7 Percent over the Last Year; Up 0.9 Percent from the First Quarter of 2024

U.S. house prices rose 5.7 percent between the second quarter of 2023 and the second quarter of 2024, according to the Federal Housing Finance Agency (FHFA) House Price Index (FHFA HPI®). House prices were up 0.9 percent compared to the first quarter of 2024. FHFA’s seasonally adjusted monthly index for June was down 0.1 percent from May.

“U.S. house prices saw the third consecutive slowdown in quarterly growth,” said Dr. Anju Vajja, Deputy Director for FHFA’s Division of Research and Statistics. “The slower pace of appreciation as of June end was likely due to higher inventory of homes for sale and elevated mortgage rates.”

emphasis added

The seasonally adjusted monthly index was declined 0.1% in June. Here is a graph from the FHFA report showing the annual change by region for June 2024 compared to June 2023. Prices have increased year-over-year everywhere. Note that the YoY increase is larger this year, compared to the YoY increase in June 2023 in seven of the nine regions.

Over the last 4 months, the FHFA seasonally adjusted index has increased at 0.8% annual rate (almost unchanged).

Case-Shiller House Prices

From S&P S&P Corelogic Case-Shiller Index Hits New All-Time High for June 2024

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.4% annual gain for June, down from a 5.9% annual gain in the previous month. The 10-City Composite saw an annual increase of 7.4%, down from a 7.8% annual increase in the previous month. The 20-City Composite posted a year-over-year increase of 6.5%, dropping from a 6.9% increase in the previous month. New York reported the highest annual gain among the 20 cities with a 9.0% increase in June, followed by San Diego and Las Vegas with annual increases of 8.7% and 8.5%, respectively. Portland once again held the lowest rank for the smallest year-over-year growth, notching a 0.8% annual increase in June.

...

The U.S. National Index, the 20-City Composite, and the 10-City Composite upward trends continued to decelerate from last month, with pre-seasonality adjustment increases of 0.5%, 0.6%, and 0.6%, respectively.After seasonal adjustment, the U.S. National Index posted a month-over-month change of 0.2%, while the 20-City and 10-City Composite reported a monthly change of 0.4% and 0.5%, respectively.

“The S&P CoreLogic Case-Shiller Indices continue to show above-trend real price performance when accounting for inflation,” says Brian D. Luke, CFA, Head of Commodities, Real & Digital Assets. “Home prices and inflation continue to factor into the political agenda coming into the election season. While both housing and inflation have slowed, the gap between the two is larger than historical norms, with our National Index averaging 2.8% more than the Consumer Price Index. That is a full percentage point above the 50-year average. Before accounting for inflation, home prices have risen over 1,100 percent since 1974, but have slightly more than doubled (111%) after accounting for inflation.”

emphasis added

This graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index was up 0.5% in June (SA). The Composite 20 index was up 0.4% (SA) in June. The National index was up 0.2% (SA) in June.

The Composite 10 SA was up 7.3% year-over-year (down from 7.7% the previous month). The Composite 20 SA was up 6.4% year-over-year (down from 6.8%). The National index SA was up 5.4% year-over-year (down from 5.9%).

And a few things to watch …

The following content is for paid subscribers only. Thanks to all paid subscribers!

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.