House Prices Increase Sharply in July

Case-Shiller National Index up Record 19.7% Year-over-year in July

Both the Case-Shiller House Price Index (HPI) and the Federal Housing Finance Agency (FHFA) HPI for July were released today.

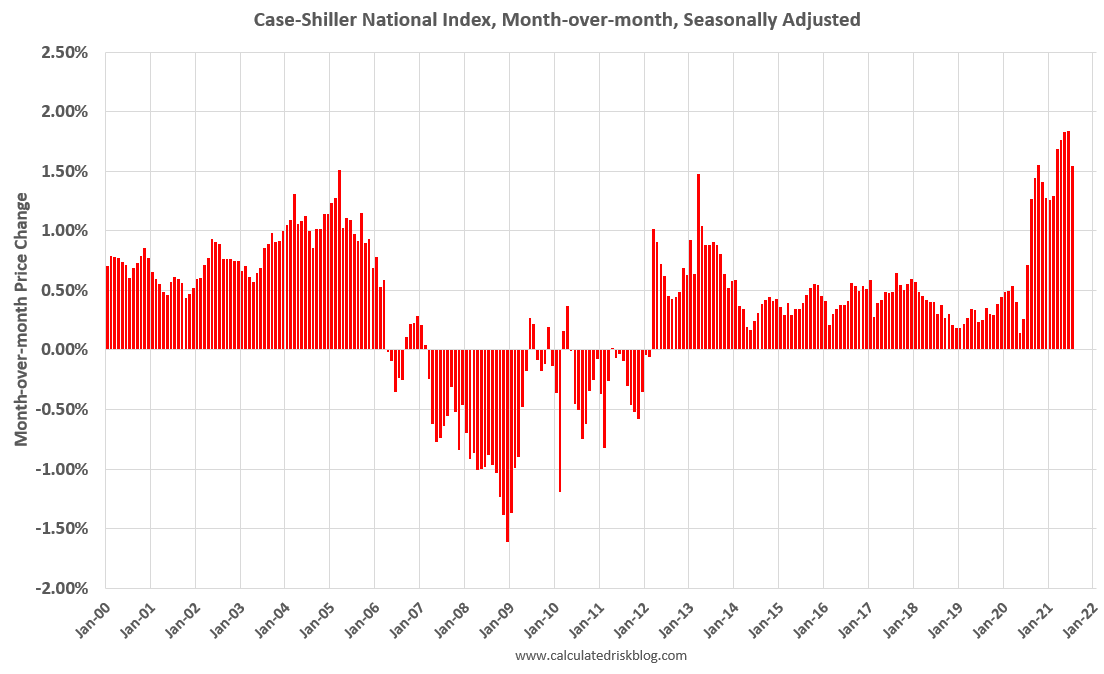

First, here is a graph of the month-over-month change in the Case-Shiller National Index (SA).

The month-over-month increase in Case-Shiller was at 1.55%; still historically high, but lower than the previous four months. So price…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.