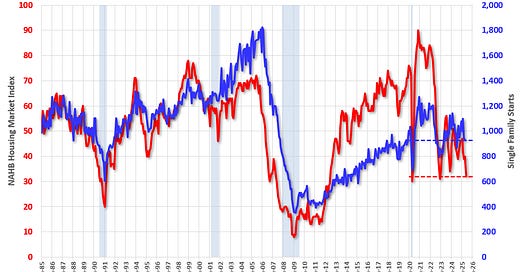

Housing Market Index and Single Family Starts

This morning, the National Association of Home Builders (NAHB) released their monthly housing market index: Builder Sentiment at Third Lowest Reading Since 2012

In a further sign of declining builder sentiment, the use of price incentives increased sharply in June as the housing market continues to soften.

Builder confidence in the market for newly built …

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.