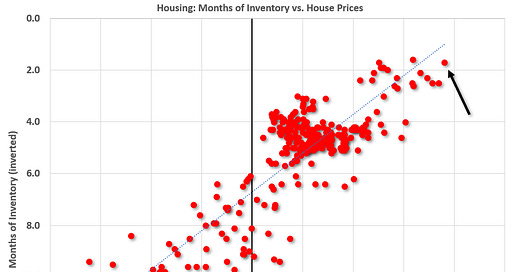

The Housing Market is Still Hot, but We are Seeing Signs of a Shift

House prices are up 20% year-over-year. Inventory is near record lows. And real estate agents are still selling homes well above list price. And on credit, lending standards have been reasonably solid, and mortgage delinquencies are very low.

However, mortgage rates are up sharply (fr…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.