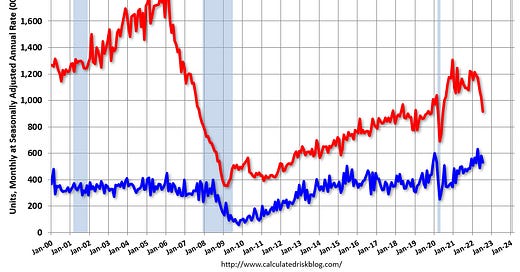

July Housing Starts: Units Under Construction Declined Slightly

Housing Starts Decreased to 1.446 million Annual Rate in July

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in July were at a seasonally adjusted annual rate of 1,446,000. This is 9.6 percent below the revised June estimate of 1,599,000 and is 8.1 percent below the July 2021 rate of 1,573,000. Single‐family housing starts in July were at a rate of 916,000; thi…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.