July ICE Mortgage Monitor: Home Prices Continue to Cool, Early Signs of Homeowner Risk Emerge

Here is the ICE July Mortgage Monitor report (pdf).

Press Release: ICE Mortgage Monitor: Amid a Cooling Housing Market, Early Signs of Homeowner Risk Emerge

Intercontinental Exchange, Inc. … released its July 2025 Mortgage Monitor report. ICE data reveals that beneath the surface of a broadly cooling but stable housing market, early signs of financial stress are emerging among subsets of homeowners. Pockets of vulnerability can be seen in rising negative equity, increased use of mortgage products that improve short-term affordability, and exposure to student loan debt.

Softening home prices expand from the Sunbelt to Western states, driving increased negative equity.

According to ICE’s Home Price Index, annual home price growth slowed to 1.3% in early June, and 30% of the largest markets have seen prices dip by at least a full percentage point from their recent highs. While this deceleration may help affordability, it could potentially weaken the equity positions of borrowers who purchased more recently, particularly those using FHA and VA loans, which are low down payment products. Nationally, one in four seriously delinquent loans would be in a negative equity position if sold at distressed (REO) prices. In certain markets, the figures are more pronounced: in Cape Coral, Fla., 27% of all 2023 and 2024 vintage loans are now underwater, while in Austin, Texas, the rate is 18% among 2022 vintage loans.

ARM and temporary buydown usage reflect affordability pressure

More than 8% of borrowers financed homes with ARMs or temporary buydowns this year, which reduce monthly payments in the first years of the loan. While these loans provide short-term relief, they may introduce future payment shock, particularly if interest rates remain elevated or reset higher.

Student loan delinquency greatly increases mortgage delinquency risk

The return of both payments and collection efforts on defaulted federal student loans, which resumed in May after a five-year pause, may put additional financial strain on some homeowners. Analysis of ICE McDash data and ICE Tradelines data powered by TransUnion shows that nearly 20% of mortgage holders also carry student loan debt. Among FHA borrowers, that number rises to nearly 30%. Borrowers delinquent on student loans are four times more likely to be delinquent on their mortgage.

“While the slowdown in home price growth may be easing affordability pressures, and negative equity volumes remain low, we’re beginning to see localized pockets of recent homebuyers becoming financially exposed,” said Andy Walden, Head of Mortgage and Housing Market Research at ICE. “Borrowers with minimal equity — particularly those who purchased recently — are often the first to be exposed when home prices soften. These early signs of stress highlight the importance of monitoring borrower-level risk as market conditions evolve.”

Meanwhile, ICE Home Price Dynamics is beginning to show the impact of softening home prices on equity positions in credit risk transfer (CRT) securitizations with the majority of CRT deals issued in 2023 and 2024 having seen modest upticks in negative equity rates in recent months.

“As figures from the July Mortgage Monitor bear out, national averages don’t tell the full story,” said Tim Bowler, President of ICE Mortgage Technology. “We’re seeing early signs of risk building within specific markets and within specific borrower populations, like borrowers with limited equity or who are behind on student loans. This is when proactive monitoring and data-driven risk management become essential. Identifying and engaging these borrowers early may prevent hardship later.”

emphasis added

Mortgage Delinquencies “Ticked Down” in May

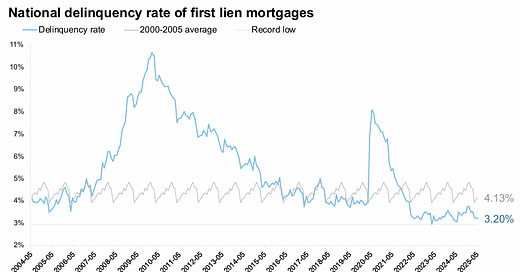

Here is a graph of the national delinquency rate from ICE. Overall delinquencies decreased in May and are below the pre-pandemic levels. Source: ICE McDash

The national delinquency rate ticked down 2 basis points (bps) to 3.20% in May, though it is up 5.2% (16 bps) year over year (YoY)

Serious delinquencies – loans 90+ days past due but not in foreclosure – improved seasonally for the fifth consecutive month but are still up 56K (14%) from the same time last year

Disaster-related delinquencies also improved, with those related to the 2024 hurricane season falling by nearly 5K (26%) month over month (MoM) and Los Angeles wildfire-related delinquencies falling by a more modest 9% MoM

For the third consecutive month, foreclosure starts, active foreclosure and foreclosure sales rose on an annual basis as VA foreclosure resumptions continue to make their way through the pipeline

While the overall non-current rate (DQ+FC) remained stable from April to May, it rose by 2% (1bps) among FHA loans, offsetting a comparable improvement among other product types

FHA loans have accounted for the bulk of the recent rise in non-current rates, with FHA non-currents up 12% YoY; non current VA and GSE loans rose 2% over the same period, while the rate for portfolio loans remained essentially flat

House Price Growth Continues to Slow

Here is the year-over-year in house prices according to the ICE Home Price Index (HPI). The ICE HPI is a repeat sales index. ICE reports the median price change of the repeat sales. The index was up 1.6% year-over-year in May, down from 2.0% YoY in April. The early look at the June HPI shows a 1.3% YoY increase.

Mortgage rates in the high 6% range and growing inventory across the country continue to cool home price growth

Annual price growth eased to 1.6% in May with ICE’s enhanced Home Price Index showing growth slowing further to 1.3% in early June marking the slowest growth rate since mid-2023

Early June data also shows home prices rose by a modest 0.02% on a seasonally adjusted basis, which is equivalent to a seasonally adjusted annualized rate (SAAR) of +0.3%, suggesting more slowing on the horizon

Single family prices were up +1.6% from the same time last year, while condo prices were down -1.3%, marking the softest condo market since 2012

More than half of the top 100 housing markets in the U.S. are seeing condo prices below last year’s levels, with the largest declines in Florida, led by Cape Coral (-12.7%) and North Port (-10.4%)

Inventory Increasing Sharply, Significant Regional Differences

This graph shows ICE’s estimate of the National inventory deficit (change from 2017 - 2019 levels).

Inventory continues to be the headline trend for the real estate industry moving into the middle of 2025

The number of homes available for sale is up +32% from the same time last year, with the deficit vs. pre-pandemic levels having fallen to -13%, down from -34% at this time last year

What’s more, the rate of improvement has accelerated in recent months, with that deficit falling by 7 percentage points over the past two months

The rate of improvement so far in 2025 puts the market on pace to return to pre-pandemic inventory levels in the fall

With home prices softening, it remains to be seen the extent to which inventory growth will slow due to homeowners foregoing listings, as they did in late 2022 and early 2023

19% fewer homes were listed for sale in May than was typical for the same month in the years immediately prior to the pandemic, a trend worth keeping an eye on in coming months

This graph illustrates the significant regional differences with inventory growth. The Northeast and Upper Midwest still have low levels of inventory. Meanwhile, prices are falling in part of Florida and Texas - and other cities with inventory above 2017 - 2019 levels.

There is much more in the mortgage monitor.