Lawler: Some Comments About Upcoming GSE MBS Purchases and an Update on Mortgage/MBS Yields and Spreads

From housing economist Tom Lawler:

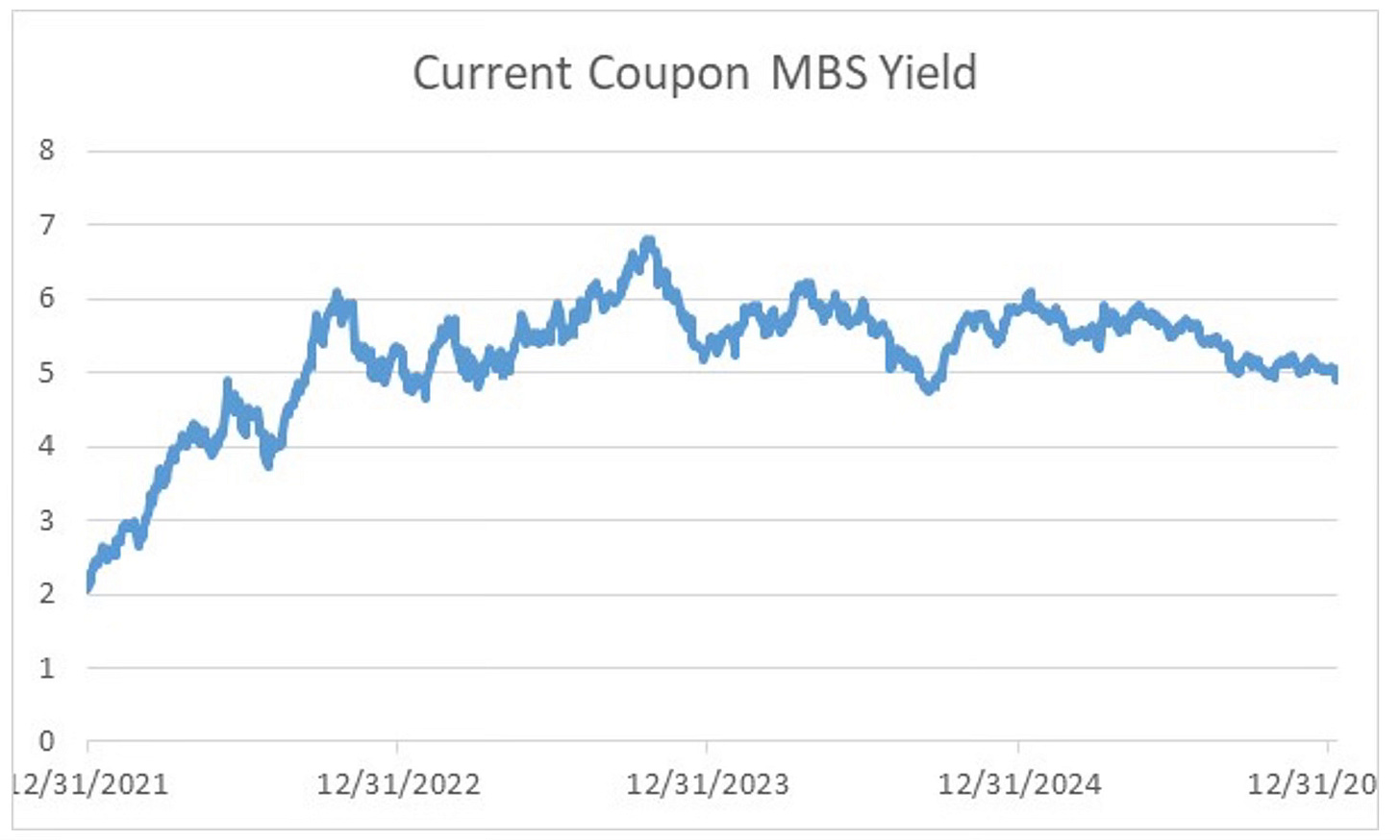

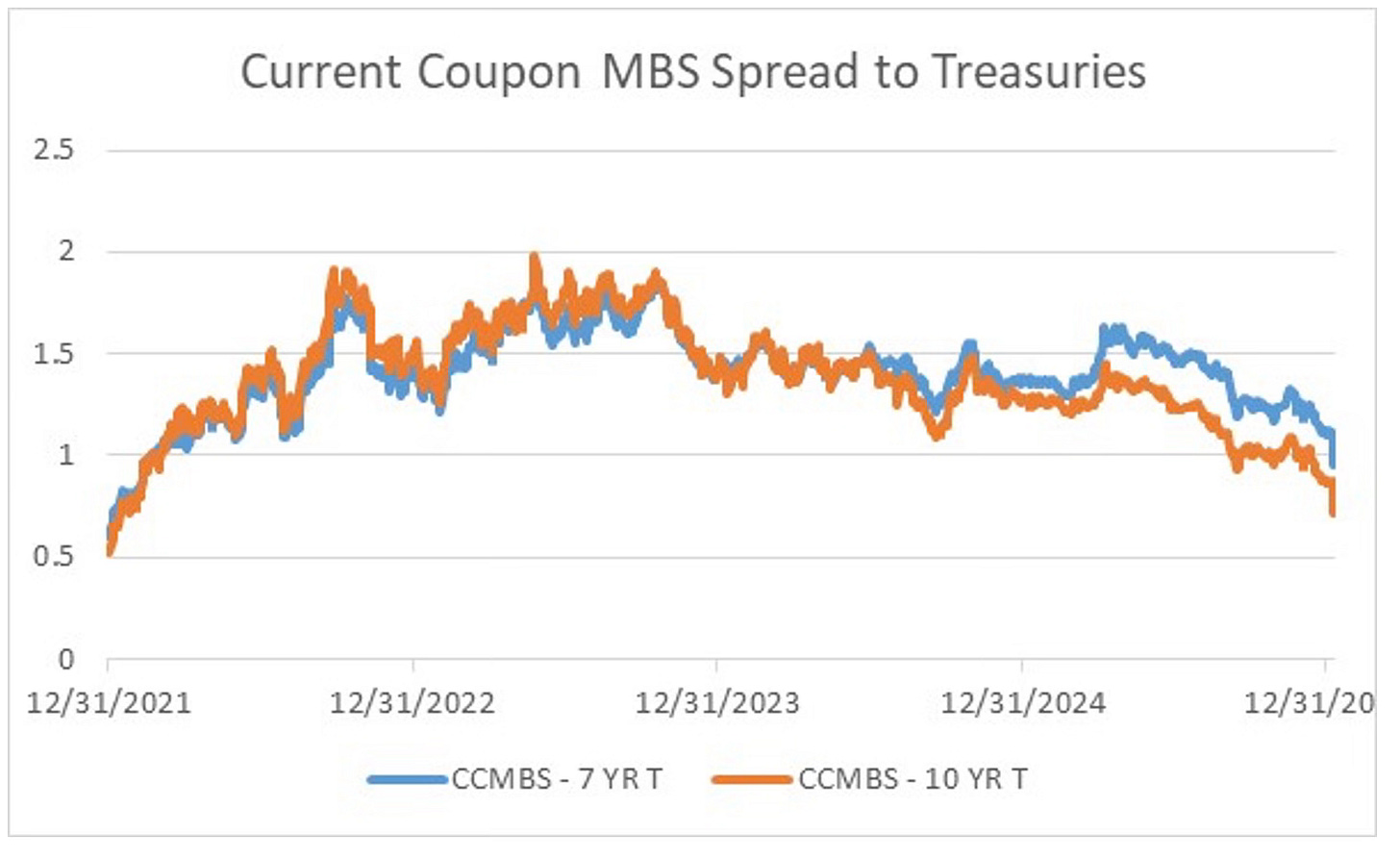

Current coupon MBS yields fell sharply from mid-afternoon Thursday to Friday’s close despite little change in Treasury yields following President Trump’s announcement that he was “instructing his Representatives (Fannie Mae and Freddie Mac) to buy $200 BILLION IN MORTGAGE BONDS (MBS).” He prefaced that statement by saying that Fannie Mae and Freddie Mac were now worth “AN ABSOLUTE FORTUNE” and now “has (sic) $200 BILLION IN CASH” (not really true), thus seemingly implying that Fannie and Freddie would use their “cash” to buy MBS.

While MBS/Treasury spreads had already been narrowing for weeks as market participants had noted that the GSEs had been modestly expanding their MBS holdings over the last few months and had speculated that they might continue to do so, this announcement came as quite a surprise, and as a result MBS/Treasury spreads narrowed by a whopping 15 bp from mid-afternoon Wednesday to Friday.

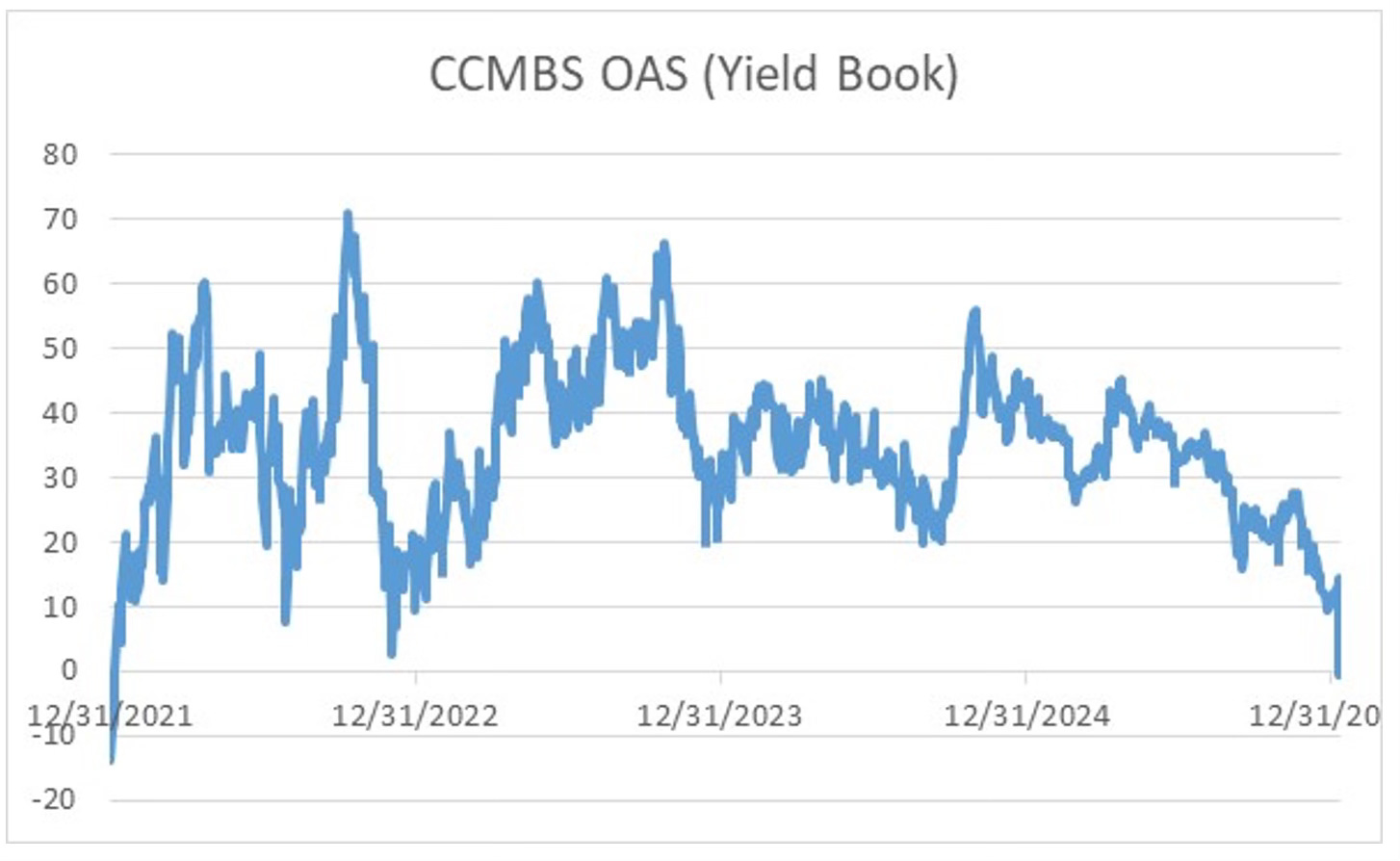

According to one widely followed option-adjusted spread model – Yield Book – the option-adjusted spread to Treasuries on current-coupon MBS (CCMBS) on Friday was negative 0.6 BP. Stated another way, after adjusting for the prepayment risk associated with mortgages backing MBS, MBS were yielding LESS than Treasuries on Friday. This negative OAS hasn’t been seen early January of 2022, when the Federal Reserve was still engaged in its ill-fated expansion of its Agency MBS holdings.

Here are a few observations on Increased GSE MBS Purchases

Why $200 billion? While I don’t know for sure, the “room” the two GSEs have to increase their retained mortgage investment portfolios under the Senior Preferred Stock Purchase Agreement with the US Treasury is right around $200 billion. While Treasury/FHFA could, I believe, alter that agreement, it seems like that is the reason behind the number.

What will be the pace of GSE MBS purchases? I haven’t seen anything explicitly on this, save for FHFA director Pule’s social media post saying “We are on it, Mr. President!”. This to me suggests that purchases will be “front-loaded” for the year.

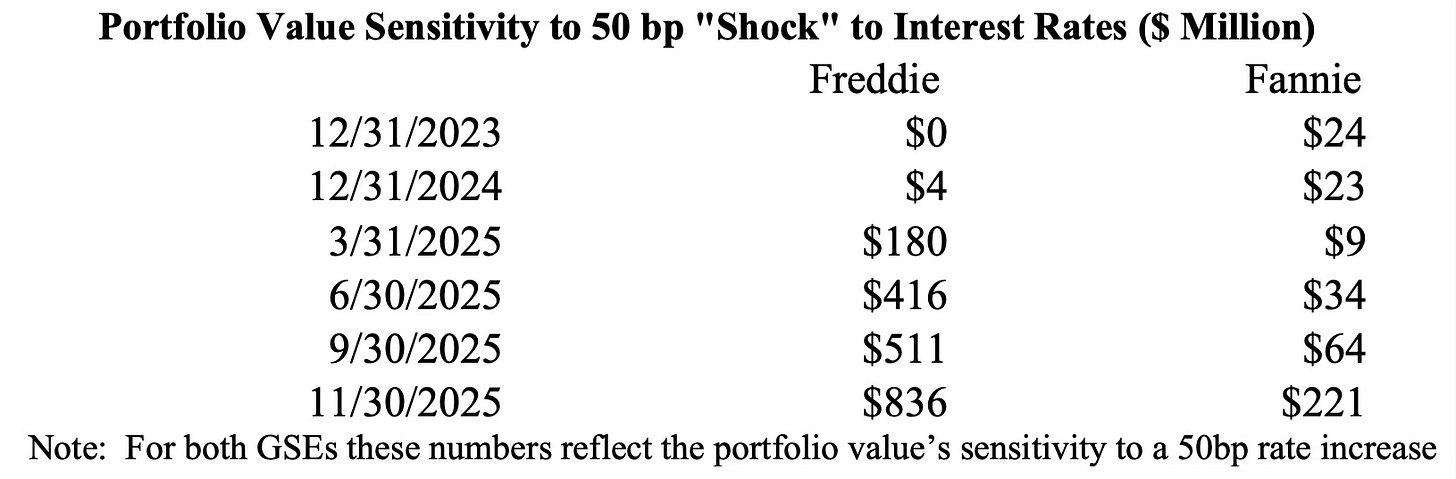

How will the GSEs fund the MBS acquisitions?While Trump’s post suggests that the GSEs will use their “huge” cash balances, that of course is not the case.To be sure, both Freddie Mac and Fannie Mae have significant holdings in their “liquidity and contingency operating” portfolios:$138 billion for Freddie Mac and $107 billion for Fannie Mae (Fannie Mae’s corporate liquidity in November was DOWN $28 billion from the end of 2024.)But those portfolios are designed for liquidity risk management purposes, and as such it would not make sense to have all of their liquidity and contingency operating portfolios in MBS, which have significant interest-rate risk.Having said that, Freddie Mac could reduce its holdings of Treasury securities, many of which are not short-term securities. (Freddie and to a lesser extent Fannie increased the maturity of its Treasury holdings in its liquidity portfolio last year, which is why their interest rate exposure rose.)

As such, both GSEs, and especially Fannie Mae, would almost certainly increase their debt to fund part if not a good portion of their increased MBS holdings.

How will the GSEs hedge their increased MBS holdings? Presumably the GSEs would not fund a large increase in their MBS holdings solely with short term debt, as that would dramatically increase their exposure to rising interest rates. Options might include a combination of an increase in long-term debt, including callable debt, an increase in pay-fixed options, and an increase in swaptions.

What would the risk-adjusted return of debt-financed MBS be? If one believes in some models, currently the option-adjusted spread to Treasuries of current-coupon MBS is slightly negative. As such, the risk-adjusted return of agency debt-financed MBS would be negative. The actual return, of course, would depend on whether or not the debt-financed MBS were “fully” hedged.

How will this affect MBS/Treasury spreads, and for how long? Obviously the announcement has already impacted such spreads. How long it might impact spreads, however, is not clear. First, how will other investors in MBS react? Will they dramatically reduce their MBS purchases or even sell some of their MBS because of the lack of relative value? Or will investors follow a “don’t fight the FMs” strategy and buy more MBS ahead of the FMs, like many investors did during the Fed’s massive but ultimately ill-fated surge in MBS holdings? After all, the $200 billion amount could technically be increased with a revision to the SPSPA by the Treasury/FHFA, though such a move might jeopardize any planned IPO.

For those looking for comparisons to what MBS/Treasury spreads did during the Fed’s massive MBS buying programs, it should be noted that a $200 billion increase in GSE MBS purchases pales in comparison to what the Fed did. E.g., from 1/7/09 to 7/14/10 Fed MBS holdings increased by $1.13 Trillion; from 1/25/12 to 7/22/15 by $914 Billion; and from 3/18/20 to 6/22/22 by $1.36 Trillion. (Actual Fed purchases during these periods were higher, reflecting repayments of principal on its MBS).

If GSE MBS purchases are limited to $200 billion, and if it appears that the FHFA/administration will not allow more than that, then the impact on MBS/Treasury spreads will not be that great, and will not be sustainable. As such, investors who look to jump into MBS ahead or along with the GSEs should do so with an exit strategy in mind.

Bessent on the “Neutral” Fed Funds Rate: What Models?

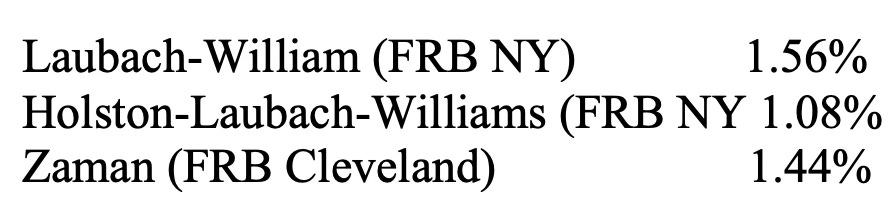

Last week Treasury Secretary Bessent said that the current federal funds rate is “substantially” above the neutral rate, and that “most” economic models would show that the “right range” (presumably neutral) range for the funds rate is between 2.5% and 3.25%. Not surprisingly, he did not cite any of these models.

While there are a lot of different models of the neutral rate, most do not provide timely updates. Below are three that recently updated their estimates for the third quarter of last year. Note that the neutral rate is a real, or inflation-adjusted, rate.

In re the FRB NY models, I believe the L-W model is superior to the H-L-W model, for reasons I’ve discussed before.

If inflation expectations were at 2%, then the range of the “neutral” fed funds rate from these models would be 3.08% to 3.56%.

However, inflation expectations are somewhat above 2%, though by how much is not clear.

If inflation expectations were at 2.25%, then the range of the “neutral” fed funds rate from these models would be 3.33% to 3.81%.

The Fed’s current fed funds target range is 3.5% - 3.75%.

Hmmmm!!!!

CR Note: This was from housing economist Tom Lawler. And a few graphs from Lawler: