March Existing Home Sales Forecast and 4th Look at Local Housing Markets

Lawler forecast; Adding Boston, California, Memphis, Minneapolis, Phoenix, and Rhode Island

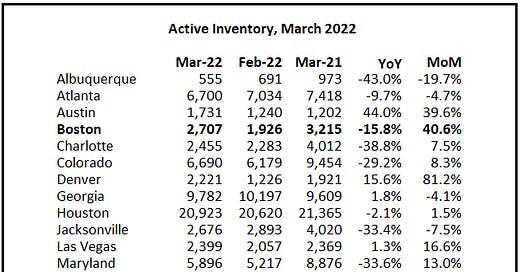

This is the fourth look at local markets in March. I’m tracking about 30 local housing markets in the US. Some of the 30 markets are states, and some are metropolitan areas. I’ll update these tables throughout the month as additional data is released.

My view is that if the housing market starts slowing, it will show up in inventory first. And we are see…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.