MBA: Mortgage Delinquencies Decreased Slightly in Q3 2024

From the MBA: Mortgage Delinquencies Decrease Slightly in the Third Quarter of 2024, Up on Annual Basis

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased slightly to a seasonally adjusted rate of 3.92 percent of all loans outstanding at the end of the third quarter of 2024 compared to one year ago, according to the Mortgage Bankers Association’s (MBA) National Delinquency Survey.

The delinquency rate was down 5 basis points from the second quarter of 2024 but up 30 basis points from one year ago. The percentage of loans on which foreclosure actions were started in the third quarter rose by 1 basis point to 0.14 percent.

“Mortgage delinquencies have inched up over the past year,” said Marina Walsh, CMB, MBA’s Vice President of Industry Analysis. “Even though there was a small, third-quarter decline in the overall delinquency rate compared to the previous quarter, this was driven by a decrease in 30-day delinquencies. Later-stage delinquencies rose last quarter, and overall delinquencies were up thirty basis points from one year ago.”

Added Walsh, “While delinquencies remain low by historical standards, the composition of loans in delinquency is changing, with more 60-day delinquencies and 90-day+ delinquencies across all major loan types, compared to last quarter and one year ago.”

Walsh further noted that the effects of Hurricanes Helene and Milton will likely appear in the next reporting period of the National Delinquency Survey, given the timing of the storms at the end of September and beginning of October.

emphasis added

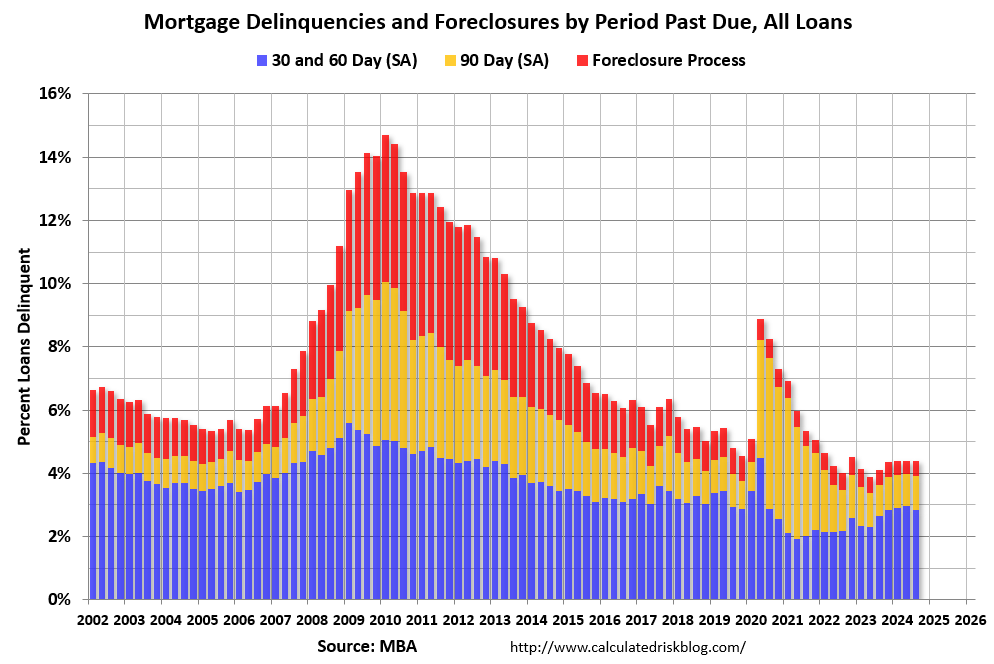

The following graph shows the percent of loans delinquent by days past due. Overall delinquencies increased in Q2. The sharp increase in 2020 in the 90-day bucket was due to loans in forbearance (included as delinquent, but not reported to the credit bureaus).

The percent of loans in the foreclosure process decreased year-over-year from 0.49 percent in Q3 2023 to 0.45 percent in Q3 2024 (red) and remains historically low.

Key findings of MBA's Third Quarter of 2024 National Delinquency Survey:

Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate decreased 14 basis points to 2.12 percent, the 60-day delinquency rate increased 3 basis points to 0.73 percent, and the 90-day delinquency bucket increased 7 basis points to 1.08 percent.

By loan type over the previous quarter, the total delinquency rate for conventional loans decreased 1 basis point to 2.63 percent. The FHA delinquency rate decreased 14 basis points to 10.46 percent, and the VA delinquency rate decreased 5 basis points to 4.58 percent.

On a year-over-year basis, total mortgage delinquencies increased for all loans outstanding. The delinquency rate increased 13 basis points for conventional loans, increased 96 basis points for FHA loans and, increased 82 basis points for VA loans from the previous year.

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the third quarter was 0.45 percent, up 2 basis points from the second quarter of 2024 and 4 basis points lower than one year ago.

The non-seasonally adjusted seriously delinquent rate, the percentage of loans that are 90 days or more past due or in the process of foreclosure, was 1.55 percent. It increased 12 basis points from last quarter and increased 3 basis points from last year. The seriously delinquent rate increased 5 basis points for conventional loans, increased 46 basis points for FHA loans, and increased 19 basis points for VA loans from the previous quarter. Compared to a year ago, the seriously delinquent rate decreased 3 basis points for conventional loans, increased 29 basis points for FHA loans and, increased 27 basis points for VA loans.

The five states with the largest quarterly increases in their overall delinquency rate were: Texas (24 basis points), Arkansas (14 basis points), Florida (13 basis points), Arizona (12 basis points), and Wyoming (9 basis points).

For the purposes of the survey, MBA asks servicers to report loans in forbearance as delinquent if the payment was not made based on the original terms of the mortgage.

The primary concern is the increase in 30- and 60-day delinquency rates, and even though the rate is historically low, it has increased from 2.30% in Q2 2023 to 2.85% in Q3 2024 (the rate declined in Q3). I don’t think this increase is much of a worry, but it is something to watch.

We will see an increase in 30-day delinquencies in Q4 due to the hurricanes.