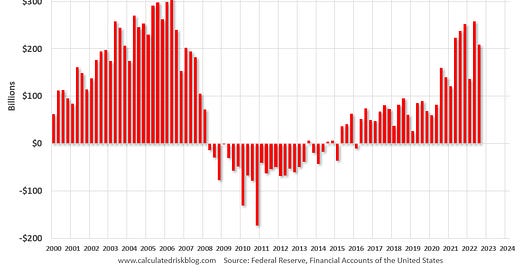

Mortgage Equity Withdrawal Still Solid in Q3

Homeowners now relying on Home Equity lines to extract equity

Refinance activity declined sharply this year as mortgage rates increased, and I was expecting MEW to also decline as fewer homeowners used cash-out refinancing. However, homeowners have switched to using home equity loans (2nd loans) to extract equity from their homes.

In the Fed’s October 2022 Senior Loan Officer Opinion Survey on Bank Lending Practices

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.