Most Housing Units Under Construction Since 1974

Housing Starts Decreased to 1.555 Million Annual Rate in September

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in September were at a seasonally adjusted annual rate of 1,555,000. This is 1.6 percent below the revised August estimate of 1,580,000, but is 7.4 percent above the September 2020 rate of 1,448,000. Single‐family housing starts in September were at a rate of 1,080,000; this is virtually unchanged from the revised August figure of 1,080,000. The September rate for units in buildings with five units or more was 467,000.

Building Permits:

Privately‐owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 1,589,000. This is 7.7 percent below the revised August rate of 1,721,000, but is virtually unchanged from the September 2020 rate of 1,589,000. Single‐family authorizations in September were at a rate of 1,041,000; this is 0.9 percent below the revised August figure of 1,050,000. Authorizations of units in buildings with five units or more were at a rate of 498,000 in September

emphasis added

The first graph shows single and multi-family housing starts since 2000 (including housing bubble).

Multi-family starts (blue, 2+ units) decreased in September compared to August. Multi-family starts were up 38% year-over-year in September.

Single-family starts (red) were unchanged in September, and were down 2% year-over-year. (starts slumped at the beginning of the pandemic, but picked up later in 2020).

The second graph shows single and multi-family starts since 1968.

The second graph shows the huge collapse following the housing bubble, and then the eventual recovery (but still not historically high).

Total housing starts in September were below expectations, and starts in July and August were revised down, combined.

Please share with friends and colleagues.The third graph shows the month to month comparison for total starts between 2020 (blue) and 2021 (red).

Starts were up 7.4% in September compared to September 2020. The year-over-year comparison are more difficult at end of 2021. In 2020, starts were off to a strong start before the pandemic, and with low interest rates, and little competing existing home inventory, starts finished 2020 strong.

The fourth graph shows starts under construction, Seasonally Adjusted (SA).

Red is single family units. Currently there are 712 thousand single family units under construction (SA). This is the highest level since 2007.

For single family, most of these homes are already sold (Census counts sales when contract is signed). The reason there are so many homes is probably due to construction delays. Since most of these are already sold, it is unlikely this is “overbuilding”, or that this will impact prices.

Blue is for 2+ units. Currently there are are 714 thousand multi-family units under construction. This is the highest level since 1974! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Census will release data next year on the length of time from start to completion, and that will probably show long delays in 2021. In 2020, it took an average of 6.8 months from start to completion for single family homes, and 15.4 months for buildings with 2 or more units.

Combined, there are 1.426 million units under construction. This is the most since 1974.

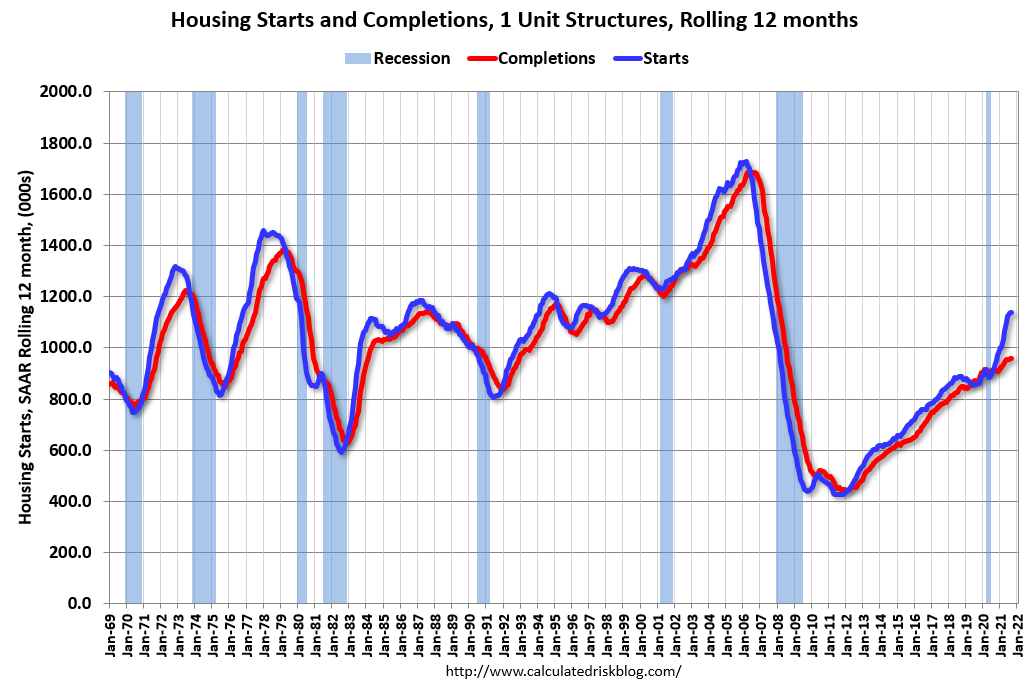

Comparing Starts and Completions

Below is a graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The blue line is for multifamily starts and the red line is for multifamily completions. Starts have picked up, but completions (red) have turned down - due to the construction delays.

The last graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer than for multi-family. The blue line is for single family starts and the red line is for single family completions.

The recent gap between starts and completions is due to the construction delays.

Please Subscribe (all content is currently Free without Ads)