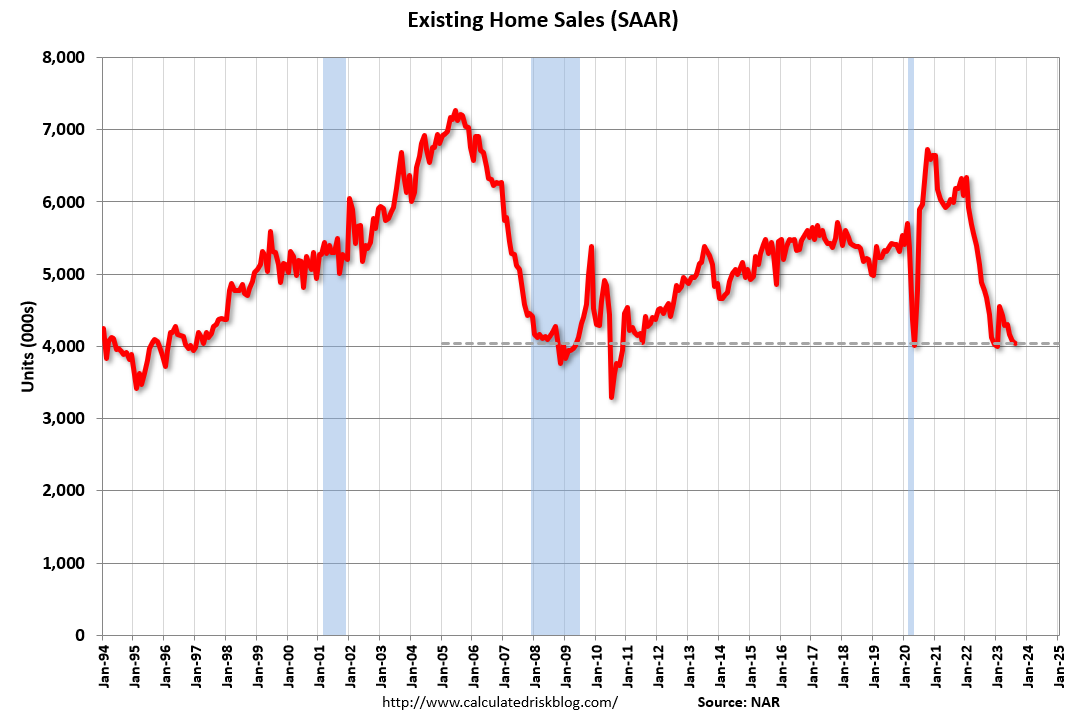

NAR: Existing-Home Sales Decreased to 4.04 million SAAR in August

Median Prices Increased 3.9% YoY in August

From the NAR: Existing-Home Sales Decreased 0.7% in August

Existing-home sales moved lower in August, according to the National Association of REALTORS®. Among the four major U.S. regions, sales improved in the Midwest, were unchanged in the Northeast, and slipped in the South and West. All four regions recorded year-over-year sales declines.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – slid 0.7% from July to a seasonally adjusted annual rate of 4.04 million in August. Year-over-year, sales fell 15.3% (down from 4.77 million in August 2022).

...

Total housing inventory registered at the end of August was 1.1 million units, down 0.9% from July and 14.1% from one year ago (1.28 million). Unsold inventory sits at a 3.3-month supply at the current sales pace, identical to July and up from 3.2 months in August 2022.

emphasis added

The sales rate was below the consensus forecast but was close to housing economist Tom Lawler’s estimate.

Sales in August (4.04 million SAAR) were down 0.7% from the previous month and were 15.3% below the August 2022 sales rate.

Housing Inventory Decreased in August

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.10 million in August down from 1.11 million in June.

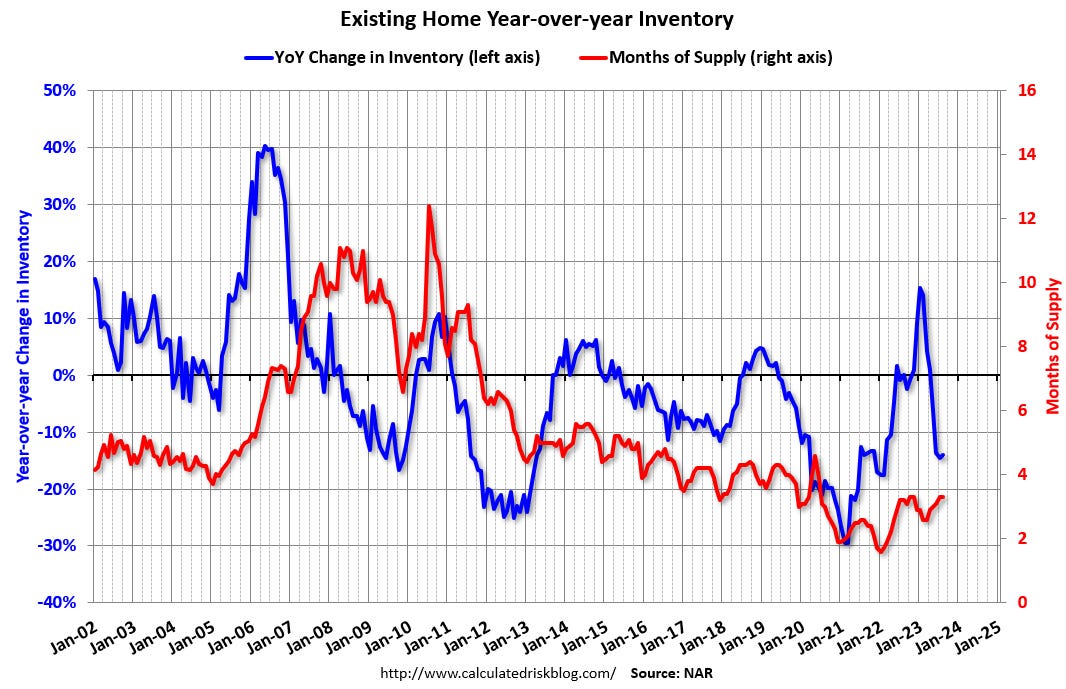

Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer. The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 14.1% year-over-year (blue) in August compared to August 2022. Months of supply (red) was unchanged at 3.3 months in August from 3.3 months in July.

Sales Year-over-Year and Not Seasonally Adjusted (NSA)

The fourth graph shows existing home sales by month for 2022 and 2023.

Sales declined 15.3% year-over-year compared to August 2022. This was the twenty-fourth consecutive month with sales down year-over-year. Since sales were declining all year in 2022, the year-over-year declines are getting smaller - even as sales declined over the last 6 months.

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.