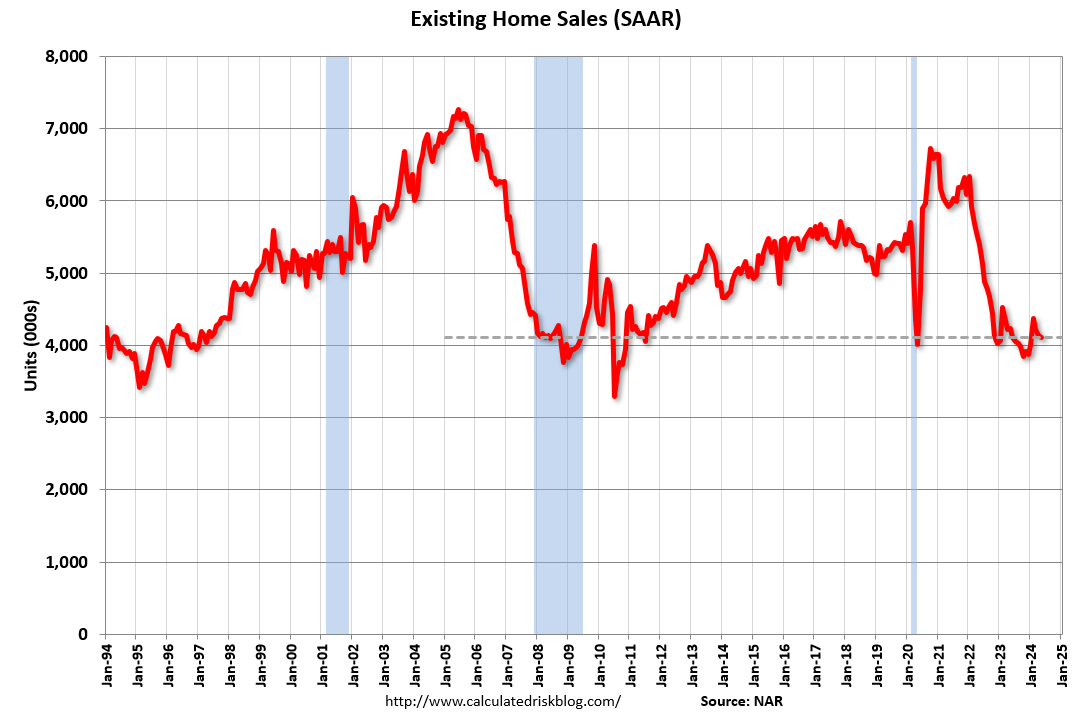

NAR: Existing-Home Sales Decreased to 4.11 million SAAR in May

Median House Prices Increased 5.8% Year-over-Year

From the NAR: Existing-Home Sales Edged Lower by 0.7% in May as Median Sales Price Reached Record High of $419,300

Existing-home sales slightly declined in May as the median sales price climbed to a record high, according to the National Association of REALTORS®. In the four major U.S. regions, sales slid month-over-month in the South but were unchanged in the Northeast, Midwest and West. Year-over-year, sales rose in the Midwest but receded in the Northeast, South and West.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – retreated 0.7% from April to a seasonally adjusted annual rate of 4.11 million in May. Year-over-year, sales waned 2.8% (down from 4.23 million in May 2023).

...

Total housing inventory registered at the end of May was 1.28 million units, up 6.7% from April and 18.5% from one year ago (1.08 million). Unsold inventory sits at a 3.7-month supply at the current sales pace, up from 3.5 months in April and 3.1 months in May 2023.

emphasis added

The sales rate was close to the consensus forecast.

Sales in May (4.11 million SAAR) were down 0.7% from the previous month and were 2.8% below the May 2023 sales rate.

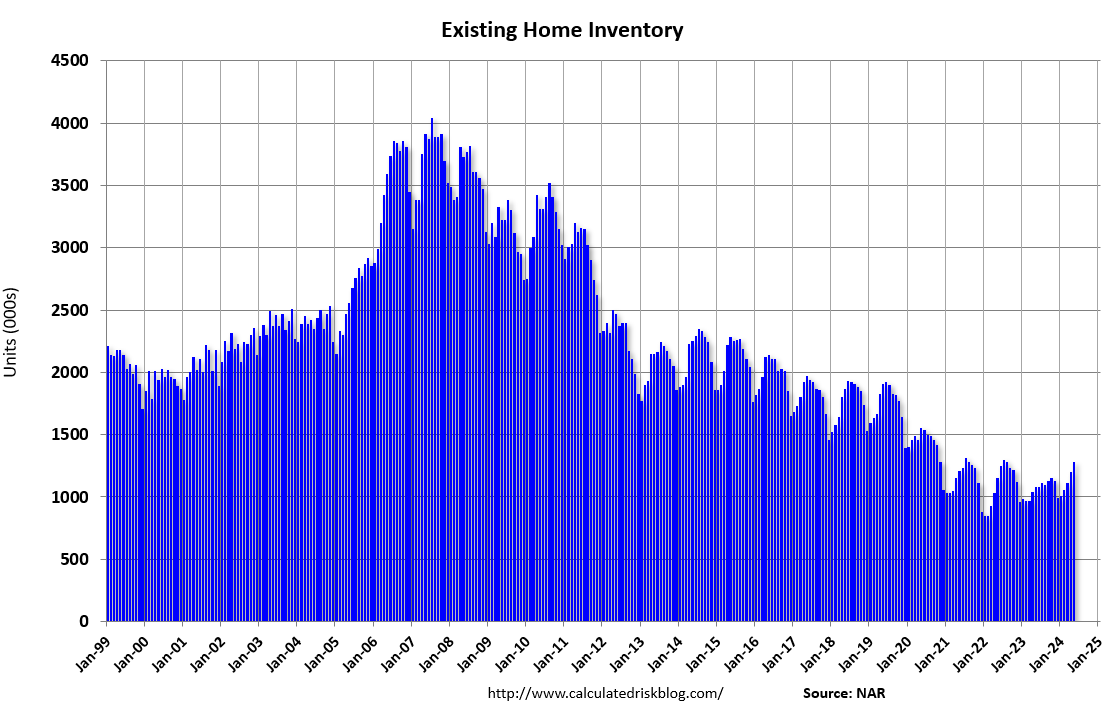

Housing Inventory Increased in May

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.28 million in May from 1.20 million the previous month.

Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer. The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 18.5% year-over-year (blue) in May compared to May 2023. Months of supply (red) increased to 3.7 months in May from 3.5 months the previous month.

Looking back to pre-pandemic levels, in May 2019 months-of-supply was at 4.3 months, so there is less supply now, on a months-of-supply basis, than prior to the pandemic. Even though sales have declined significantly compared to 2019, inventory has fallen even more - pushing down months-of-supply.

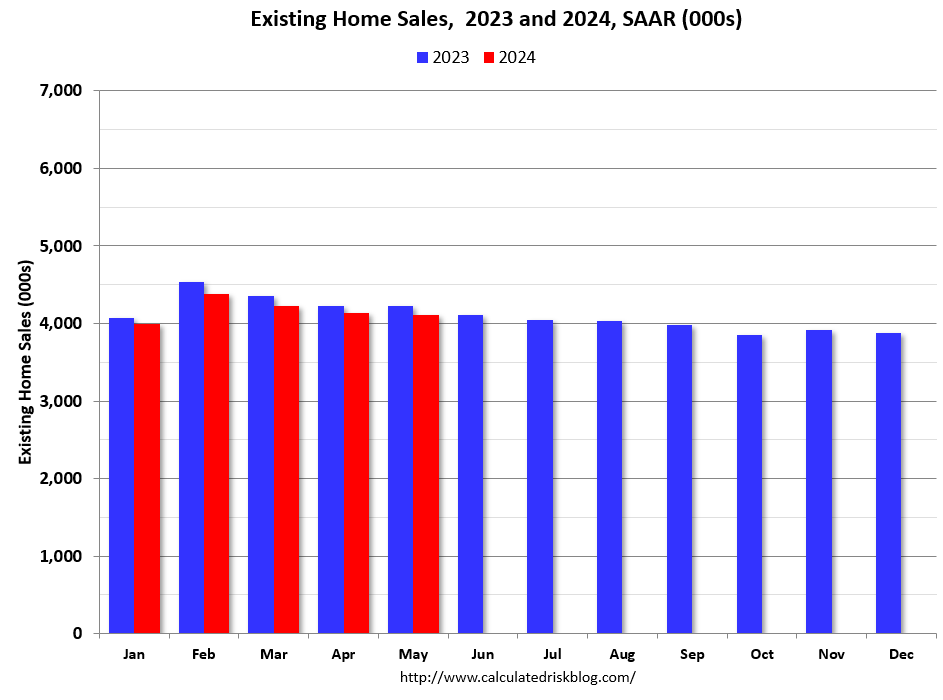

Sales Year-over-Year and Not Seasonally Adjusted (NSA)

The fourth graph shows existing home sales by month for 2023 and 2024.

Sales declined 2.8% year-over-year compared to May 2023. This was the thirty-third consecutive month with sales down year-over-year.

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.