New Home Sales Decrease Sharply to 610,000 Annual Rate in October

Median New Home Price is Down 5% from the Peak due to Change in Mix

Important: Sales in October were impacted by the hurricanes. The south region was down 27.7% year-over-year (“South” includes Florida, the Carolinas and Georgia - states hit hardest by hurricanes Helene and Milton). Excluding the South, sales were up about 8% year-over-year.

The Census Bureau reported New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 610 thousand. The previous three months were revised down, combined.

Sales of new single-family houses in October 2024 were at a seasonally adjusted annual rate of 610,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 17.3 percent below the revised September rate of 738,000 and is 9.4 percent below the October 2023 estimate of 673,000.

emphasis added

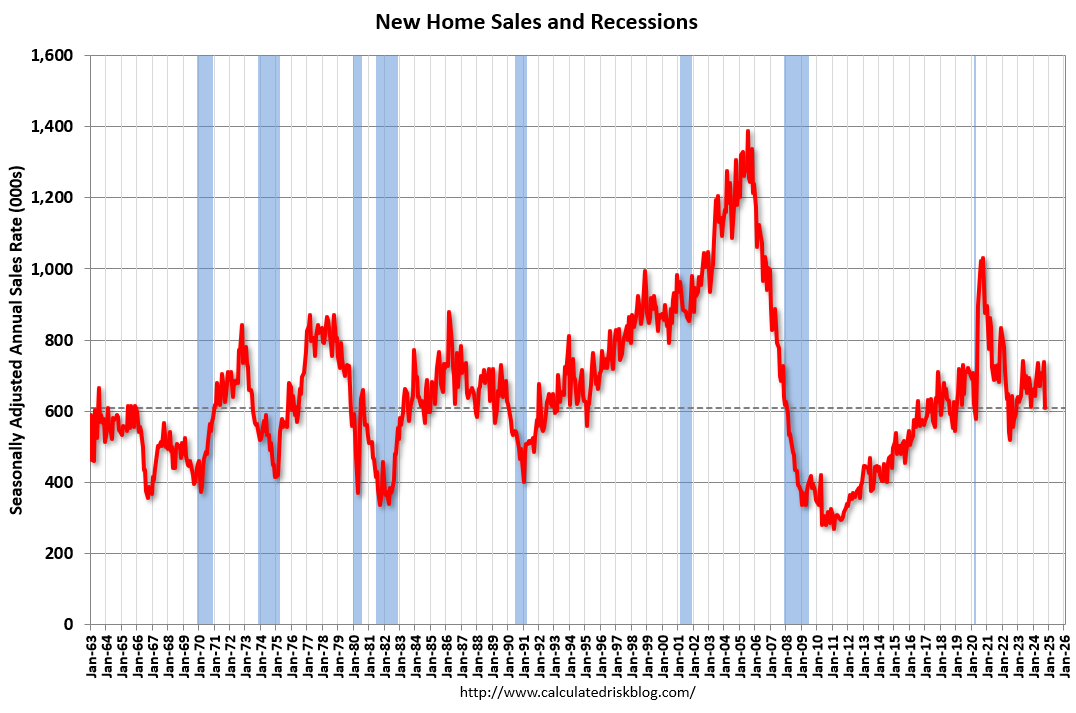

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

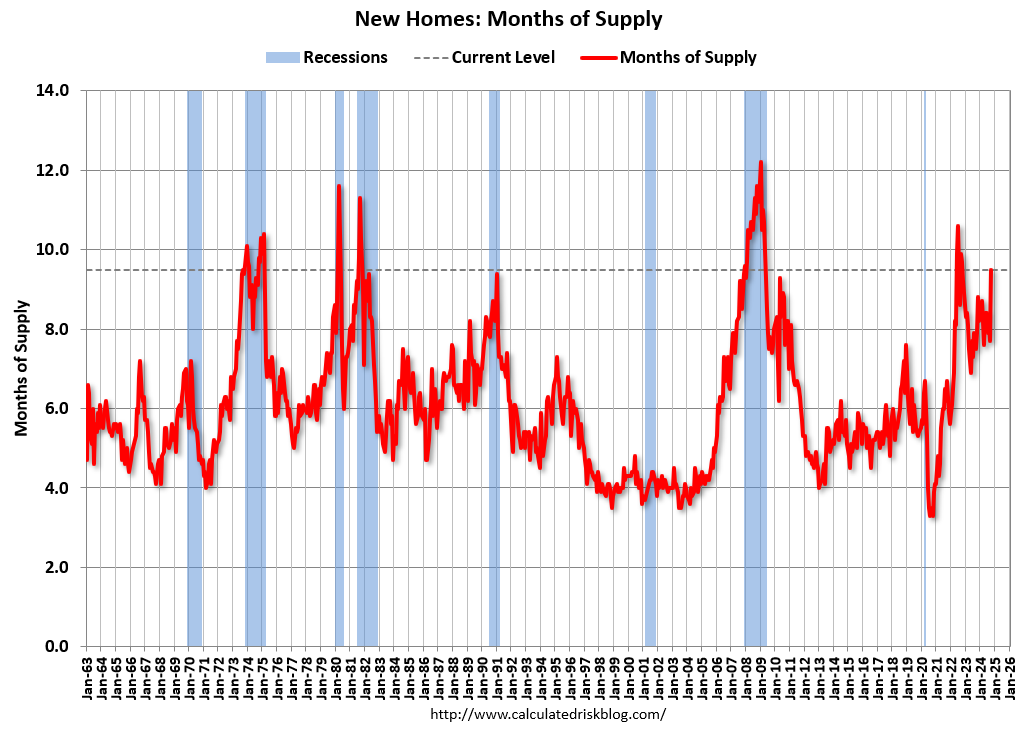

New home sales were below pre-pandemic levels. The second graph shows New Home Months of Supply.

The months of supply increased in October to 9.5 months from 7.7 months in September. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020. This is above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of October was 481,000. This represents a supply of 9.5 months at the current sales rate."

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed. The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale (red) - at 113 thousand - is almost quadruple the record low of 31 thousand in February 2022. This is the most since 2009, and somewhat above the normal level of completed homes for sale.

The inventory of homes under construction (blue) at 265 thousand is very high but is about 17% below the cycle peak in July 2022. The inventory of homes not started is at 103 thousand - this is the all-time high.

The fourth graph shows new home sales for each month, Not Seasonally Adjusted (NSA), for a few selected periods. Black is the maximum sales per month during the bubble (2005) and light gray is the minimum sales during the bust (2008 - 2011). The most recent six years are shown (2019 through 2024).

The following content is for paid subscribers only. Thanks to all paid subscribers!

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.