New Home Sales decrease to 590,000 Annual Rate in November

Average New Home Price is Down 14% from the Peak

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 590 thousand. The previous three months were revised down.

Sales of new single‐family houses in November 2023 were at a seasonally adjusted annual rate of 590,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 12.2 percent below the revised October rate of 672,000, but is 1.4 percent above the November 2022 estimate of 582,000.

emphasis added

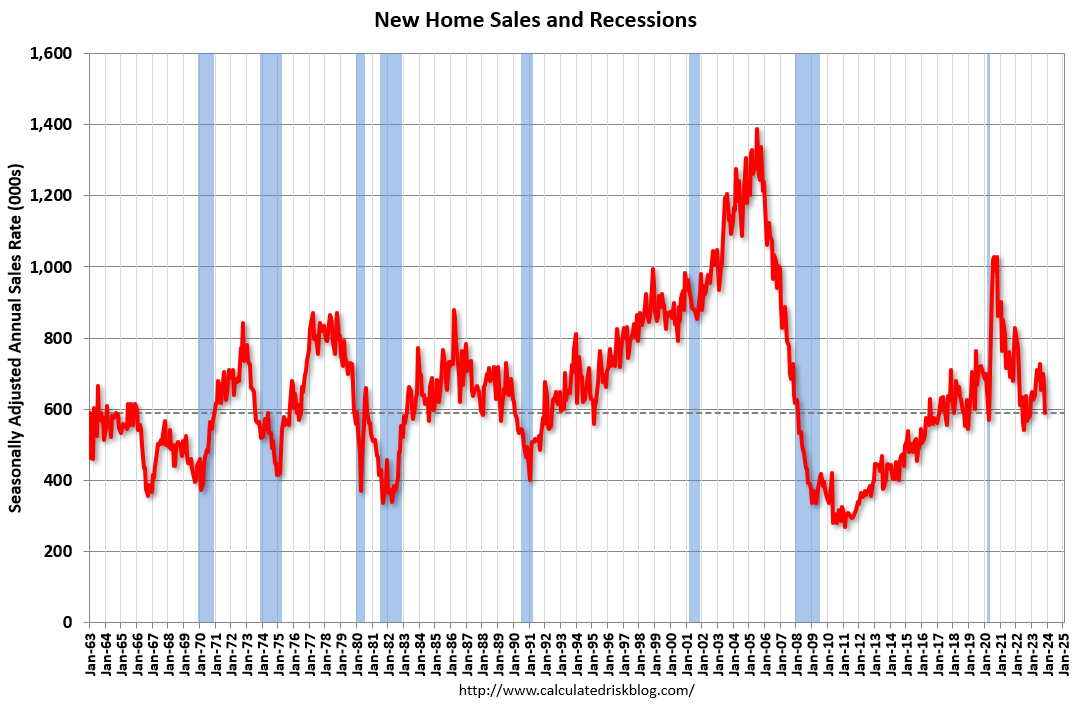

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

New home sales were slightly below pre-pandemic levels. The second graph shows New Home Months of Supply.

The months of supply increased in November to 9.2 months from 7.9 months in October. The all-time record high was 12.2 months of supply in January 2009. The all-time record low was 3.3 months in August 2020. This is well above the top of the normal range (about 4 to 6 months of supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of November was 451,000. This represents a supply of 9.2 months at the current sales rate."

On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."

Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed. The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale (red) - at 78 thousand - is more than double the record low of 32 thousand in 2021 and early 2022. This is close to the normal level of completed homes for sale.

The inventory of homes under construction (blue) at 267 thousand is very high, and about 16% below the cycle peak in July 2022. The inventory of homes not started is at 106 thousand - this is the all-time high.

The fourth graph shows new home sales for each month, Not Seasonally Adjusted (NSA), for a few selected periods. Black is the maximum sales per month during the bubble (2005) and light gray is the minimum sales during the bust (2008 - 2011). The most recent five years are shown (2019 through 2023).

In November 2023 (red column), 41 thousand new homes were sold (NSA). Last year, 41 thousand homes were also sold in November. The all-time high for November was 86 thousand in 2005, and the all-time low for November was 20 thousand in 2010.

The next graph shows new home sales for 2022 and 2023 by month (Seasonally Adjusted Annual Rate). Sales in November 2023 were up 1.4% from November 2022. Year-to-date sales are up 3.9% compared to the same period in 2022.

Although sales disappointed in November, there will be more sales in 2023 than in 2022.

5 1/2 Months of Unsold Inventory Under Construction

The next graph shows the months of supply by stage of construction. “Months of supply” is inventory at each stage, divided by the sales rate.

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.