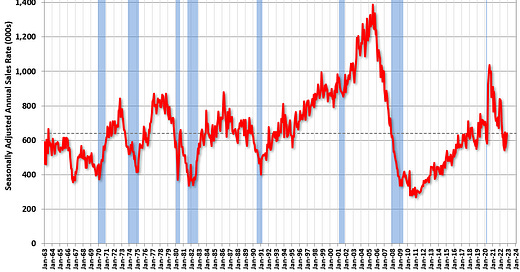

New Home Sales Increased in November; Previous 3 Months Revised Down Sharply

New Home Sales Increase to 640,000 Annual Rate in November

The Census Bureau reports New Home Sales in November were at a seasonally adjusted annual rate (SAAR) of 640 thousand.

The previous three months were revised down sharply.

Sales of new single‐family houses in November 2022 were at a seasonally adjusted annual rate of 640,000, according to estimates released jointly today by the U.S. Census Bureau and the …

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.