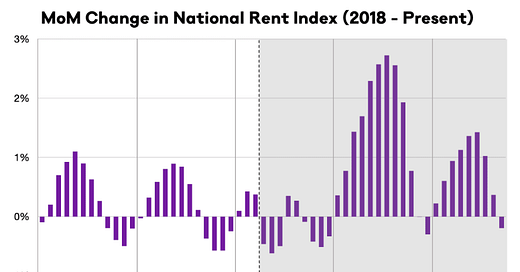

Pace of Rent Increases Continues to Slow

Higher Rents will continue to impact measures of inflation in 2022

Another monthly update on rents. First, from ApartmentList.com: Apartment List National Rent Report

Welcome to the October 2022 Apartment List National Rent Report. Our national index fell by 0.2 percent over the course of September, marking the first time this year that the national median rent has declined month-over-month. The timing of this slight di…

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.