Part 1: Current State of the Housing Market; Overview for mid-June 2024

This 2-part overview for mid-June provides a snapshot of the current housing market.

I always like to start with inventory, since inventory usually tells the tale! And currently inventory is increasing year-over-year but is still well below pre-pandemic levels.

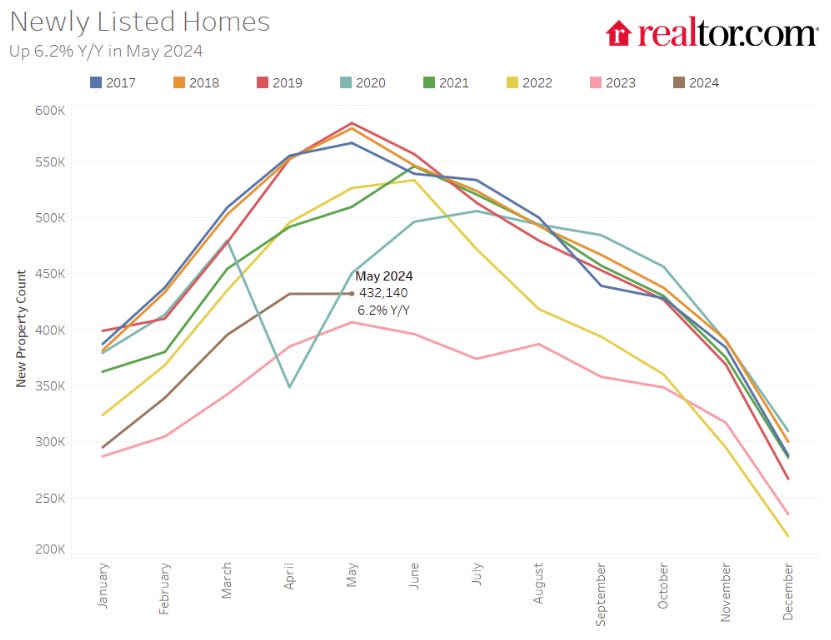

New Listings for Existing Homes Up Year-over-year in May

Here is a graph of new listing from Realtor.com’s May 2024 Monthly Housing Market Trends Report showing new listings were up 6.2% year-over-year in May. New listings are still well below pre-pandemic levels. From Realtor.com:

However, sellers continued to list their homes in higher numbers this May as newly listed homes were 6.2% above last year’s levels. While a notable deceleration from last month’s 12.2% growth rate, it marks the seventh month of increasing listing activity after a 17-month streak of decline.

Note the seasonality for new listings. December and January are seasonally the weakest months of the year for new listings, followed by February and November. New listings will be up year-over-year in 2024, but still below normal levels.

There are always people that need to sell due to the so-called 3 D’s: Death, Divorce, and Disease. Also, in certain times, some homeowners will need to sell due to unemployment or excessive debt (neither is much of an issue right now).

And there are homeowners who want to sell for a number of reasons: upsizing (more babies), downsizing, moving for a new job, or moving to a nicer home or location (move-up buyers). It is some of the “want to sell” group that has been locked in with the golden handcuffs over the last couple of years, since it is financially difficult to move when your current mortgage rate is around 3%, and your new mortgage rate will be above 7%.

But time is a factor for this “want to sell” group, and eventually some of them will take the plunge. That is probably why we are seeing more new listings now.

Impact on Active Inventory

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.