I started the year taking Fed Chair Jerome Powell’s approach to the impact of policy: I’d wait to see what was implemented before changing my outlook.

Now we know a little more. Although there is still significant uncertainty, it appears that tariffs will stay (and likely increase in early April). Deportations will likely pickup. And net legal immigration will slow sharply.

On immigration and deportations, Goldman Sachs economists wrote in February:

We expect net immigration to slow further to 750k per year, well below the pace of the last three years but only moderately below the normal pre-pandemic pace. This would consist of 750k net authorized immigrants per year and zero net unauthorized immigrants, with roughly 500k deportations per year offsetting a similar number of asylum seekers and other entrants. …

In a more extreme risk scenario where the immigration crackdown creates a climate in which unauthorized immigrants are afraid to go to work or employers are afraid to employ them, the economic consequences would be more serious because unauthorized immigrants already in the US account for 4-5% of the total workforce and 15-20% in some industries. Abruptly losing these workers could be very disruptive for many of these industries and have a larger inflation impact.

We are also seeing a sharp decline in international tourism that will impact hotels and the travel industry. However, my focus is on housing.

A few impacts:

• Tariffs will lead to higher costs. I spoke to a contractor last week who hasn’t seen any price increases yet, but he said he had received “warning letters” from key suppliers about likely price increases. The uncertainty around tariffs also makes it more difficult to bid projects.

• Less immigration will lead to less household formation. This suggests less demand for housing, especially for rentals.

• An immigration crackdown would lead to fewer workers in construction. This would push up costs for construction. This would also lead to more rental vacancies.

This suggests higher costs for construction and less demand for housing.

On regulations, the NAHB reported this month:

[B]uilders are starting to see relief on the regulatory front to bend the rising cost curve, as demonstrated by the Trump administration's pause of the 2021 IECC building code requirement and move to implement the regulatory definition of ‘waters of the United States’ under the Clean Water Act consistent with the U.S. Supreme Court’s Sackett decision.

However, most regulations are at the state and local level, so any regulatory relief will likely be minor.

And another factor is the recent stock market volatility. Ten percent corrections are common, a further sell-off will have a negative wealth effect for potential home buyers. Some buyer hesitancy - due to the market volatility - might be the reason Lennar reported they “Didn't see typical seasonal pickup after February" for new home sales.

Finally, it is difficult to ascertain the 2025 impact of DOGE, but it appears negative for employment this year.

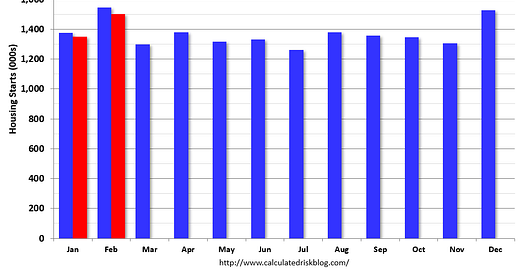

What does this mean for housing starts, new home sales and house prices?

The following content is for paid subscribers only. Thanks to all paid subscribers!

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.