Q2 Update: Delinquencies, Foreclosures and REO

REO: lender Real Estate Owned

Even with the recent weakness in house prices, it is important to note that there will NOT be a surge in foreclosures that could lead to cascading house price declines (as happened following the housing bubble) for two key reasons: 1) mortgage lending has been solid, and 2) most homeowners have substantial equity in their homes.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

But it is still important to track delinquencies and foreclosures.

Here is some data on REOs through Q2 2025 …

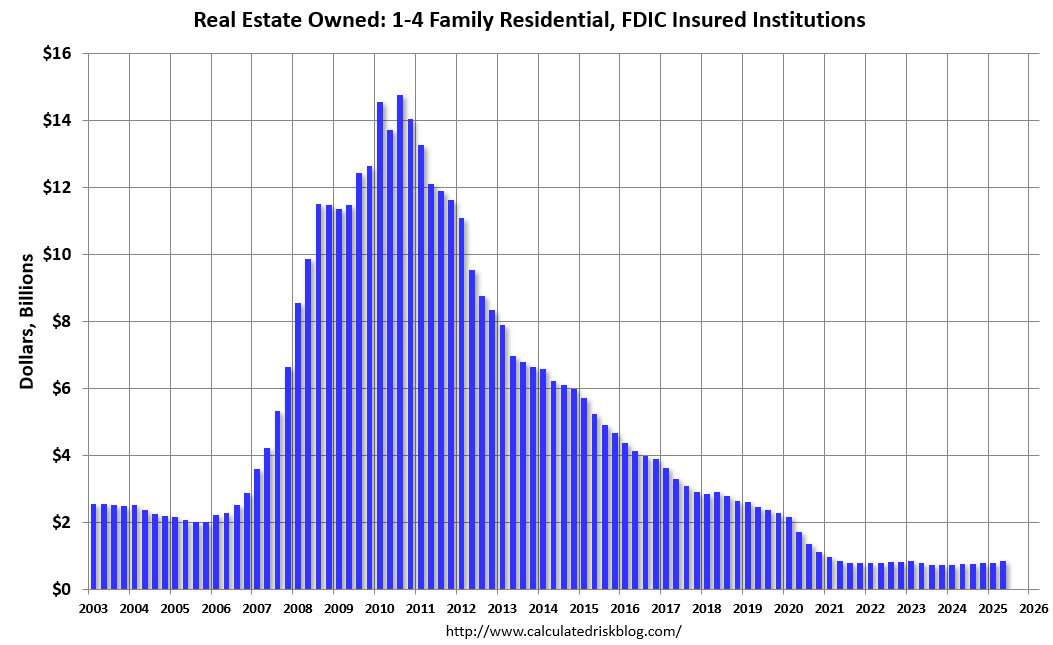

This graph shows the nominal dollar value of Residential REO for FDIC insured institutions based on the Q2 FDIC Quarterly Banking Profile released last week. Note: The FDIC reports the dollar value and not the total number of REOs.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) was up 15% YOY from $766 million in Q2 2024 to $852 million in Q2 2025. This is still historically extremely low.

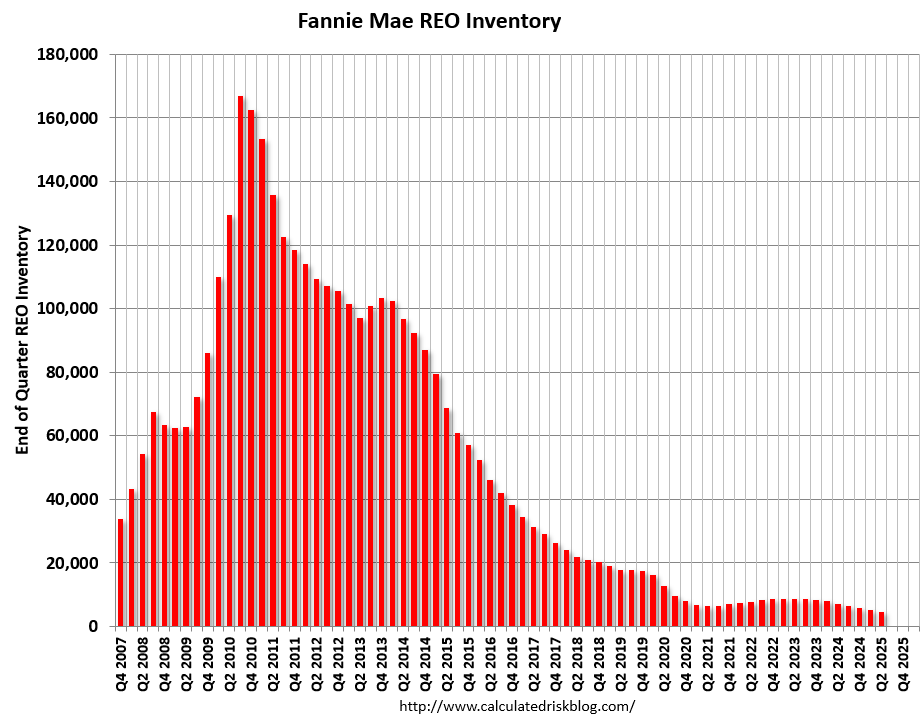

Fannie Mae reported the number of REOs decreased to 4,666 at the end of Q2 2025, down 11% from 5,236 at the end of the previous quarter, and down 35% year-over-year from 7,179 in Q2 2024. Here is a graph of Fannie Real Estate Owned (REO).

This is very low and well below the pre-pandemic levels. REOs are a lagging indicator. REOs increase when borrowers struggle financially and have little or no equity, so they can’t sell their homes - as happened after the housing bubble. That will not happen this time.

Here is some data on delinquencies …

It is important to note that loans in forbearance are counted as delinquent in the various surveys but not reported to the credit agencies.

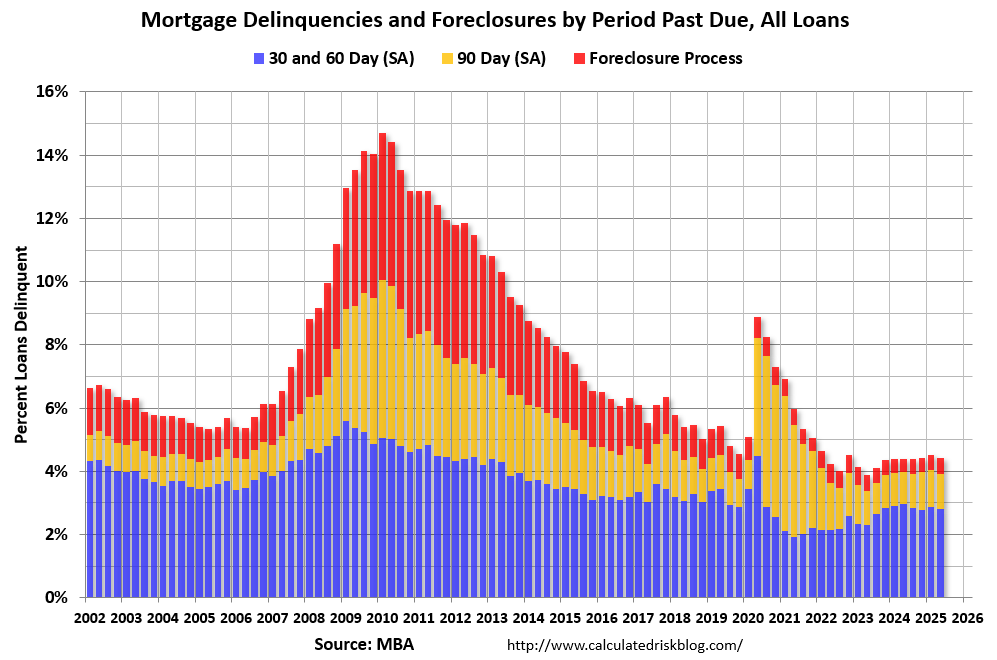

Here is a graph from the MBA’s National Delinquency Survey through Q2 2025.

The percent of loans in the foreclosure process increased year-over-year from 0.43 percent in Q2 2024 to 0.48 percent in Q2 2025 (red) but remains historically low.

From the MBA:

Compared to last quarter, the seasonally adjusted mortgage delinquency rate decreased for all loans outstanding. By stage, the 30-day delinquency rate decreased 4 basis points to 2.10 percent, the 60-day delinquency rate decreased 1 basis point to 0.72 percent, and the 90-day delinquency bucket decreased 6 basis points to 1.11 percent. ...

The delinquency rate includes loans that are at least one payment past due but does not include loans in the process of foreclosure. The percentage of loans in the foreclosure process at the end of the second quarter was 0.48 percent, down 1 basis point from the first quarter of 2025 and 5 basis points higher than one year ago.emphasis added

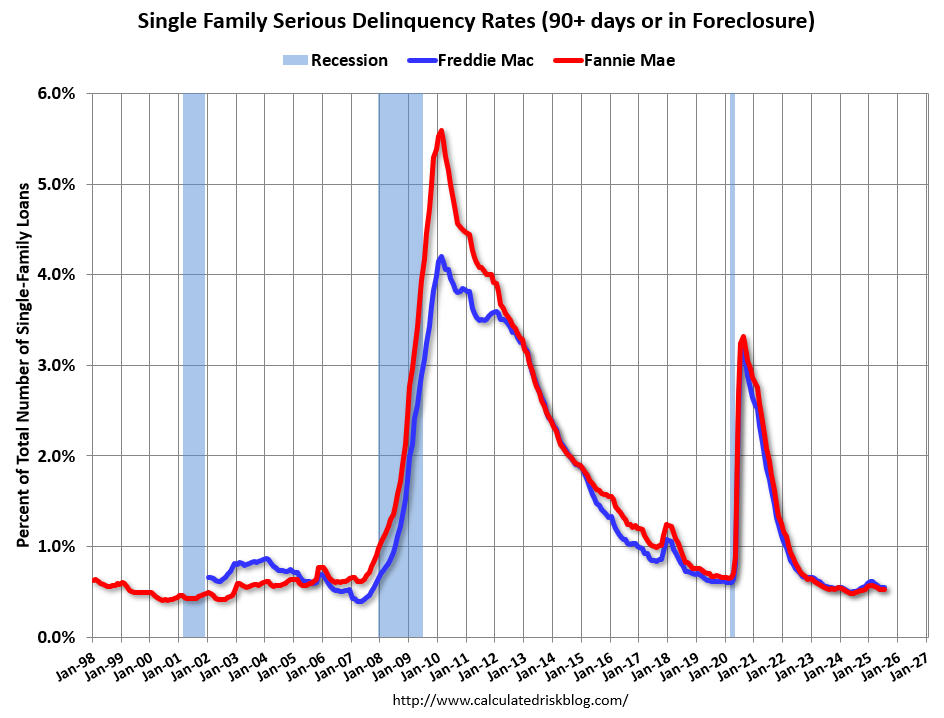

Both Fannie and Freddie release serious delinquency (90+ days) data monthly.

This graph shows the recent decline in serious delinquencies. This is very low.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure". The pandemic related increase in serious delinquencies was very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they have been able to restructure their loans once they were employed.

And on foreclosures …

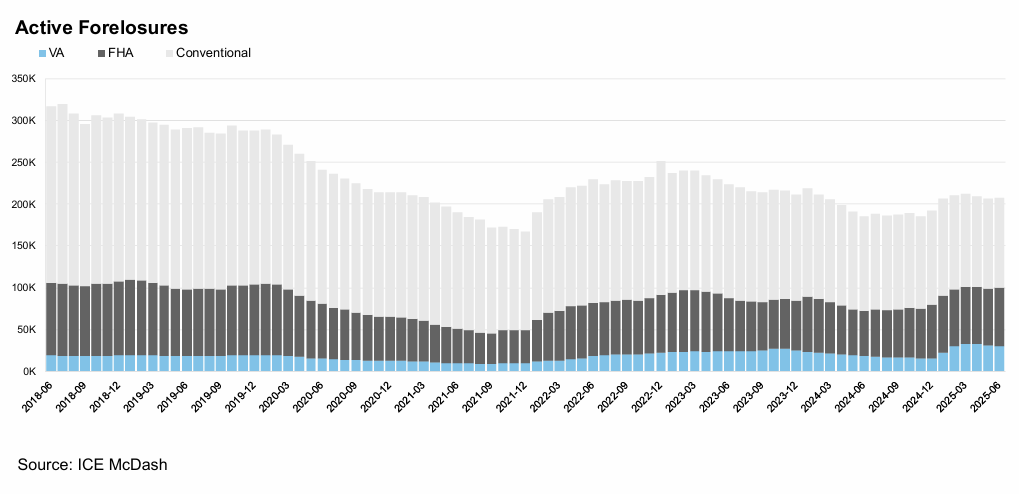

ICE reported that active foreclosures are still very low but have increased recently. have decreased and are near the records. From ICE: ICE August Mortgage Monitor report

Foreclosure activity remains low, even compared to the already low levels entering the COVID-19 pandemic

Only 208K mortgages were in active foreclosure nationwide entering Q3, nearly 30% below the same month in 2019

That said, activity is slowly trending higher with the number of loans in active foreclosure, foreclosure starts, and sales all rising year over year in each of the past four months

The rise in active foreclosures (+12%) was primarily driven by FHA and VA loans, with foreclosures on conventional mortgages down 5% from the same time last year

The number of VA loans in active foreclosure is up 61% from a year ago, when there was a moratorium on VA foreclosures

Perhaps more noteworthy is the 30% rise in active foreclosures among FHA loans despite continuing loss mitigation programs

FHA foreclosures will likely become a focal point in late 2025 and early 2026 as COVID-era loss mitigation provisions expire and are replaced with new, more restrictive workout options

The bottom line is there will likely be an increase in delinquencies and foreclosures, but there will not be a huge wave of foreclosures as happened following the housing bubble. The distressed sales during the housing bust led to cascading price declines, and that will not happen this time.