In 2021, I pointed out that with the end of the foreclosure moratoriums, combined with the expiration of a large number of forbearance plans, we would see an increase in REOs in late 2022 and into 2023. And there was a slight increase.

However, I also argued this would NOT lead to a surge in foreclosures and significantly impact house prices (as happened following the housing bubble) since lending has been solid and most homeowners have substantial equity in their homes.

Yesterday CoreLogic reported on homeowner equity: CoreLogic: US Home Equity Growth Rebounds in the Third Quarter of 2023

The report shows that U.S. homeowners with mortgages (which account for roughly 63% of all properties) saw home equity increase by 6.8% year over year, representing a collective gain of $1.1 trillion and an average increase of slightly more than $20,000 per borrower since the third quarter of 2022. …

From the third quarter of 2022 to the third quarter of 2023, the total number of homes in negative equity decreased by 8% from 1.1 million homes or 2% of all mortgaged properties.

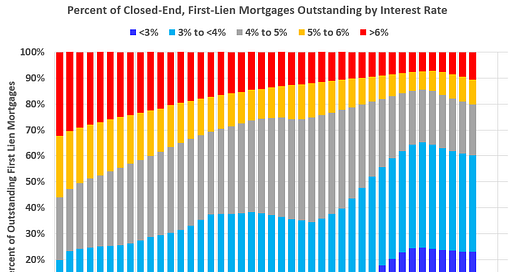

And on mortgage rates, here is some data from the FHFA’s National Mortgage Database showing the distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding at the end of each quarter since Q1 2013 through Q2 2023 (Q3 2023 data will be released in a few weeks).

This shows the surge in the percent of loans under 3%, and also under 4%, starting in early 2020 as mortgage rates declined sharply during the pandemic. Currently 22.9% of loans are under 3%, 60.3% are under 4%, and 79.9% are under 5%.

With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

Some simple definitions (for housing):

Forbearance is the act of refraining from enforcing mortgage debt.

Delinquency is the failure to make mortgage payments on a timely basis.

Foreclosure is when the mortgage lender takes possession of the property after the mortgagor failed to make their payments. “In foreclosure” is the process of foreclosure.

REO (Real Estate Owned) is the amount of real estate owned by lenders.

Here is some data on REOs through Q3 2023 …

Keep reading with a 7-day free trial

Subscribe to CalculatedRisk Newsletter to keep reading this post and get 7 days of free access to the full post archives.